Canadian Housing Flashes Warning Signal

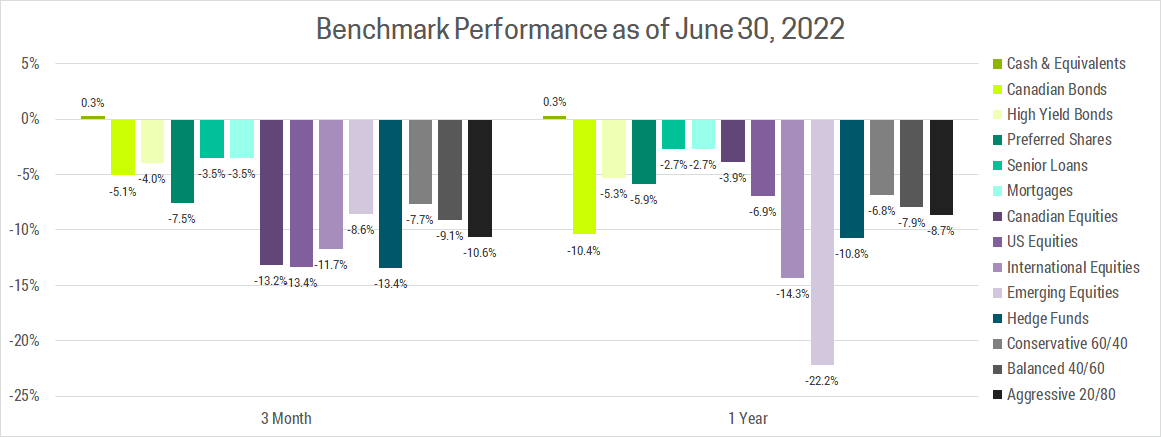

Markets continued selling off in Q2 as persistently high and rising inflation forces central banks to raise interest rates. The effect was felt most acutely in speculative assets like cryptocurrency (-70% from the highs), ARK Innovation fund (-72%), long-term bonds (-32%), technology stocks (NASDAQ -31%) and any assets that derive more of their value from the very long-term. While shorter-term assets have been spared from the worst of the sell-off, what makes this correction unique is that nearly every major asset class is declining at the same time. A standard balanced portfolio with 60% global equities and 40% bonds is down ~16% so far this year.

IS A RECESSION COMING?

What started off as an inflation/interest rate driven repricing has since morphed into fears of recession. The main question for equity investors at this juncture is whether we’re headed for a recession or simply a growth slowdown. We believe the global economy will avoid recession for at least another year as growth simply moderates from extremely (unsustainable) high levels following the stimulus fueled re-opening boom. After all, consumer balance sheets are in great shape which has allowed elevated spending to continue fueling the economic expansion. The most significant risk to this view is that consumer sentiment is at a 50-year low, so if consumers act as if we’re in a recession and cut spending accordingly, it becomes a self-fulfilling prophecy.

We prefer to put more weight on actual consumer behavior (spending remains high) as opposed to surveys, which supports our view that growth will simply moderate this year and not collapse into recession. If we’re wrong and a recession does develop this year, we expect it would be modest and short lived given the lack of financial excesses in the household, corporate and financial sectors of most major economies. In addition, China is stimulating their economy heading into the 20th National Congress later this year to solidify support as president Xi Jinping pursues an unprecedented 3rd term in power. They have ample firepower to pursue growth given low domestic inflationary pressures.

While odds of a recession are low in the near-term, we expect a recession will have to occur in a few years time in order to bring inflation down to tolerable levels (<3%). We have never resolved an inflation crisis without inducing a recession and this time is likely to be no different. It’s just that positioning for an inevitable recession is premature as economic growth was so strong leading into this slowdown. Inflation is taking a bite out of consumer spending power, but it will take time for this to eat through the excess savings created during the pandemic. Furthermore, while interest rates are rising, they are not yet economically restrictive to the point they will induce a recession.

The key factor determining how far and fast interest rates will rise, is inflation. Since we spoke about this last quarter, in Q1 2021, and Q2 2020, we advise anyone interested in inflation to check those out. Inflation will remain a hot topic but given that we’ve already spoken about it in-depth and it’s now on everyone’s minds, we want to focus the rest of this commentary on another risk that hits close to home, the Canadian housing market.

CANADIAN HOUSING MARKET OVERVIEW

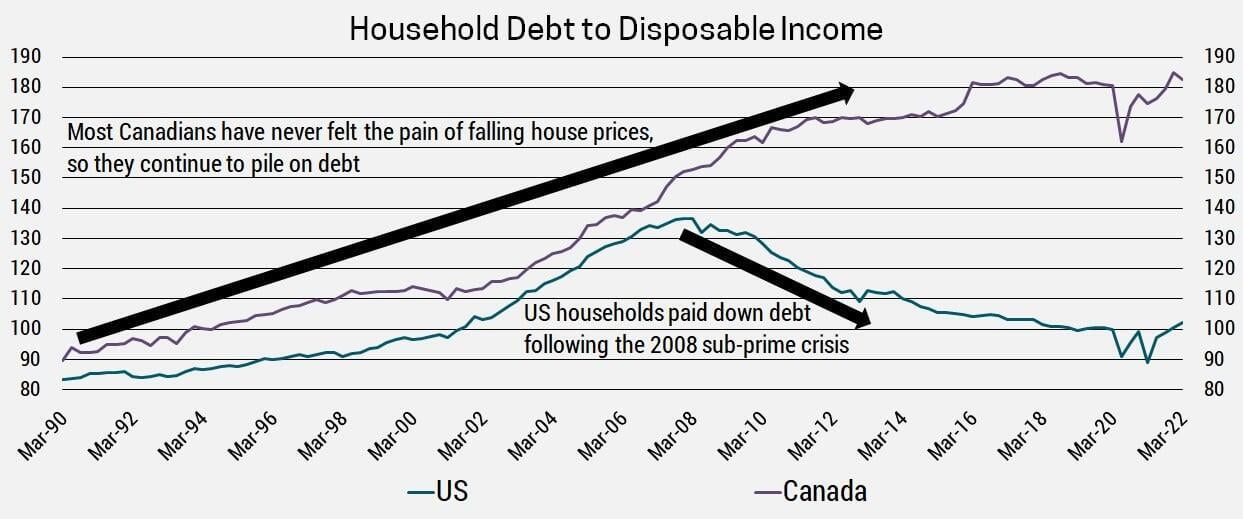

The Bank of Canada (BoC), along with most developed world central banks, is dramatically raising interest rates to fight off inflation. What sets us apart is the massive amount of debt, which has been fueled by a multi decade rally in home prices that was turbo charged since the pandemic. As a result, the Canadian economy is much more interest rate sensitive at a time when the BoC policy rate looks set to exceed 3.5% by the middle of next year (2% higher than today). The likely result is a significant drop in home prices and with more of Canadians paycheques going towards interest, a spending decline in other areas resulting in a slowing economy. The effects will likely last for years as the pain experienced by borrowers forces them to pay down debt, thereby slowing economic growth similar to what the US experienced after the sub-prime crisis of 2008.

HOW EXPENSIVE IS CANADIAN REAL-ESTATE?

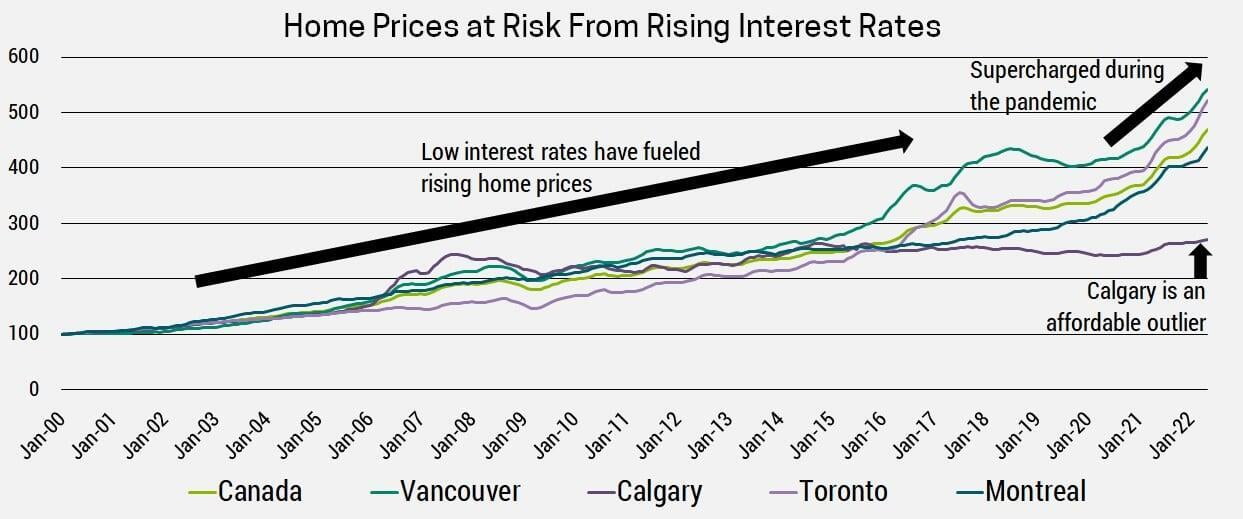

The answer depends on where you live. Nationally we’ve seen a ~350% increase in real home prices (i.e. Net of Inflation) since 2000. Some argue the rise in prices reflects a trend towards larger, higher quality homes, but the data does not support this view. Most of the increase in home square footage happened prior to 2000. Since then, we’ve only seen a ~15% size increase while prices rose 350%. Furthermore, Canada is not the only country building bigger homes, yet our home prices have vastly outpaced most global peers.

Simply put, homes are 3.5X more expensive, but not 3.5X bigger or 3.5X nicer.

Source: Teranet National Bank Home Price Index

The main reason for the dramatic run-up in prices is low interest rates, which have allowed homeowners and investors to increasingly bet on persistent capital appreciation. Rent has not kept pace with prices because borrowing costs have kept mortgage payments reasonable. Strong rent control regulation in provinces like BC mean investors will be unable to raise rent fast enough to cover rising interest rate costs. This will encourage them to sell properties while the flow of new investors slows due to expectations of falling home prices and the increasing appeal of higher bond yields.

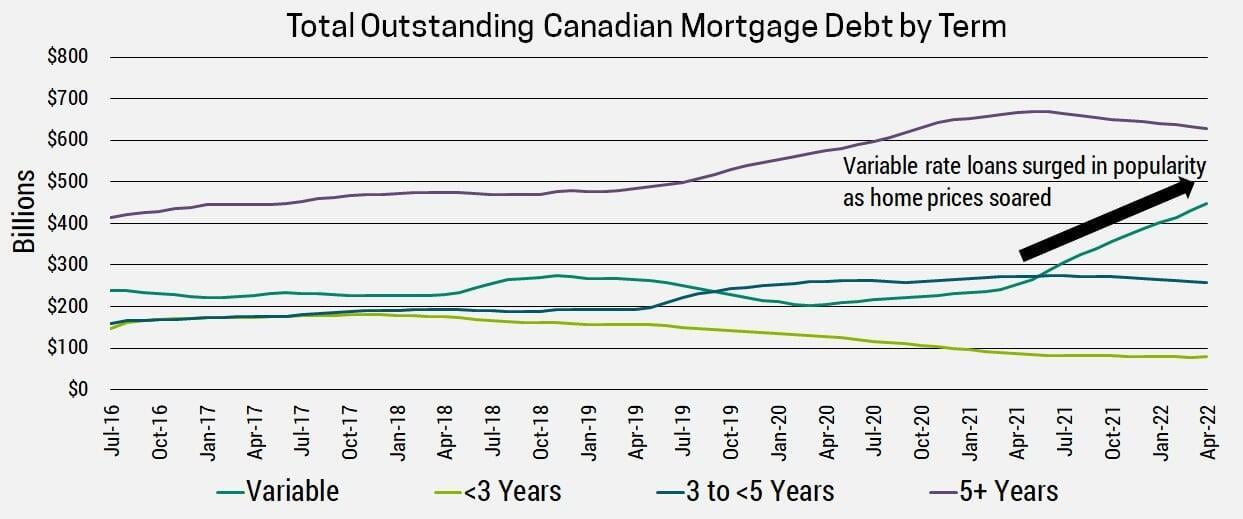

While the biggest risk is faced by highly leveraged borrowers, Canadian banks are more exposed than investors realize. The BoC dropped interest rates to the floor in March 2020 and since this time already high home prices rocketed to nosebleed levels. There have been $883 billion in uninsured mortgage loans initiated from April 2020 to April 2022 (last data available), representing 78% of all Canadian mortgages (i.e. only 22% of pandemic era loans are CMHC insured). $373 billion of these are uninsured variable rate mortgages, meaning they have limited equity (~20%), are backed by homes at nosebleed prices and will feel the effect of rising interest rates immediately.

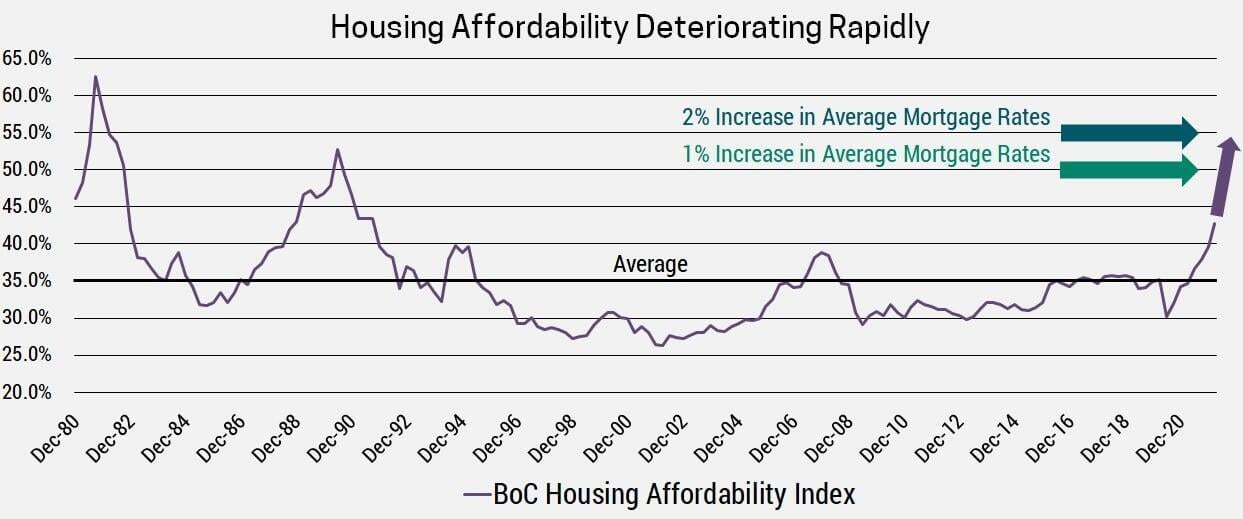

AFFORDABILITY DECLINING RAPIDLY

The dramatic run-up in prices did not affect housing affordability while interest rates remained on the floor. The Housing Affordability Index (chart below) shows the percentage of disposable income that an average household puts towards housing related expenses. While this typically makes up a third, it will likely exceed 50% by the end of this year, a level last seen in the 1980s.

The effects will be felt almost immediately since variable rate mortgages surged in popularity during the pandemic to become the most popular term. That means the majority of homes purchased recently at nosebleed prices are on variable rates! While most won’t see their payments rise until the renewal date, they will likely see their equity wiped out and amortization lengthen. This would bring more sellers to the market at prices that buyers can’t afford based on higher interest rates, which means prices simply have to fall.

IMPACT ON INVESTORS

Homeowners will feel the squeeze of higher mortgage payments and falling home prices, but ultimately will have a limited impact on supply/demand since people still need a place to live. Meanwhile, investors make up a growing share of home purchases (rose from 19% in 2020 to 22% today) and as prices have risen, they’ve been extracting equity as a way to purchase even more properties. As mortgage rates rise and home prices fall, demand from investors could evaporate and potentially add even more supply to the market.

It’s likely we’ll see a combination of the following outcomes for the market to reach equilibrium. Unfortunately, none of them are great for investors:

- Wage Increases: Incomes could rise 15% to offset each 1% increase in interest rates. This would largely come at the expense of corporate profit margins.

- BoC Capitulates: The BoC could decide not to hike interest rates too far, for fear of a housing market collapse. Unfortunately, this means inflation would remain uncomfortably high and the CAD would decline meaningfully as investors prefer to own currencies with a higher yield.

- House Prices Decline: For each 1% increase in mortgage rates, prices would need to fall ~10% for payments to remain the same. Even if we avoid a worst-case scenario where banks take significant loan losses, they are still likely to see new loan demand slow.

- Curtail Spending: Consumers could simply cut back on all other expenses in order to make their mortgage payments. This means almost all companies in Canada are indirectly impacted as consumers reign in spending.

PORTFOLIO STRATEGY CHANGE

We have reduced our exposure to mortgage investments and Canadian equities, which we believe is prudent given the significant risks faced by the housing market. So far, the timing has worked in our favor since we sold on strength as Canada was outperforming. This was partially due to the war in Ukraine, which sent commodity prices soaring and benefitted Canada’s significant materials, oil and gas exposure. This tailwind is unlikely to last forever, so we believe it was a good time to take some profits.

We’re putting this cash to work through a new investment in US banking stocks. The subprime crisis of 2008 caused the US housing market to burst and ever since Americans have been paying down their debt. This means they have ample room to increase borrowing, benefiting US banks relative to Canadian banks who may see their loan portfolio shrink. Furthermore, rising interest rates increase their Net Interest Margin (NIM) as they continue to borrow cheap (chequing accounts still pay almost nothing) while they can now lend at far higher rates (30-year US mortgage rates have doubled).

Since the US has less household debt and higher inflation, we expect their banks loan portfolio’s and NIM to rise faster than Canada’s. The cherry on top is that US banks are cheaper than their Canadian peers. This aligns with our continued preference for Value stocks, which trade at a discount in terms of earnings, cash flow, book value, etc.

If you have any questions, comments or would like to become a client please do not hesitate to reach out. You can email me or schedule a free 30-minute consultation using the link below.