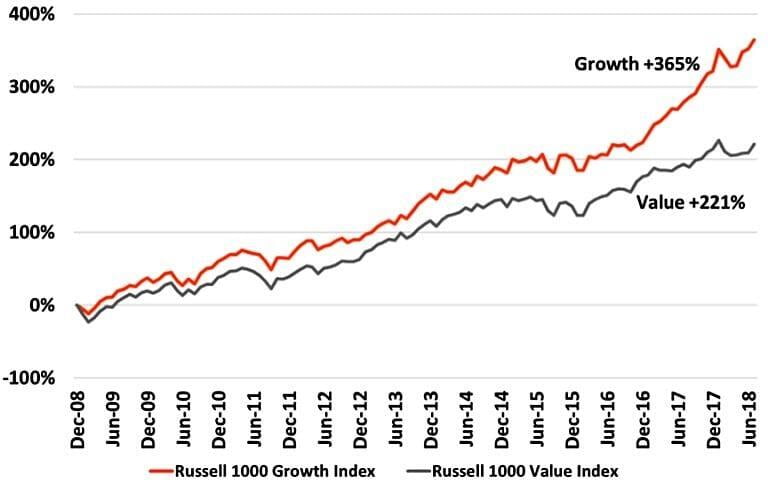

Following the financial crash, we have been stuck in a relatively low-growth and low-interest rate environment. Given this backdrop, firms with better growth prospects have been extremely attractive for investors as they are able to borrow cheap and reinvest this capital into higher growth projects. As a result, we have seen a massive decade long divergence between Growth and Value stocks as seen in the chart below.

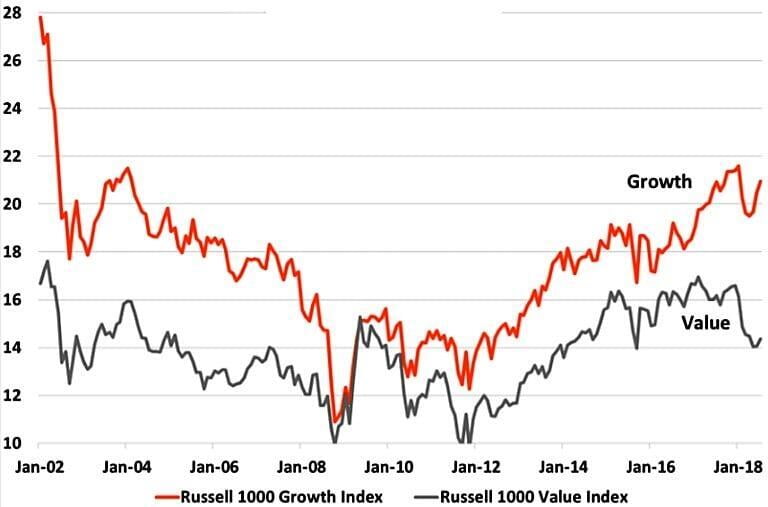

This leads us to ask two questions: is this outperformance justified and is it likely to continue? Well, over this time frame earnings for Growth stocks have risen over 80%, meanwhile Value stocks earnings rose just over 30%. This demonstrates exactly what you might expect, Growth companies were able to grow their earnings faster and therefore outperform. But this is just half of the story, the other side is valuation as seen in the price-to-earnings chart below.

As you can see, Growth stocks tend to trade at a premium to Value stocks over time, due to the fact that they are expected to grow faster. 2009 was unique from a valuation perspective as Growth and Value stocks were priced similarly, meaning you could effectively buy companies with higher expected earnings and sales growth rates at the same price as their peers. This seems like an obvious mispricing by the markets and as you might expect, since 2009 growth stocks have lived up to their name and generated higher growth rates. Therefore, the significant outperformance of Growth stocks is due to both low valuations in 2009 and subsequently stronger growth rates over this decade.

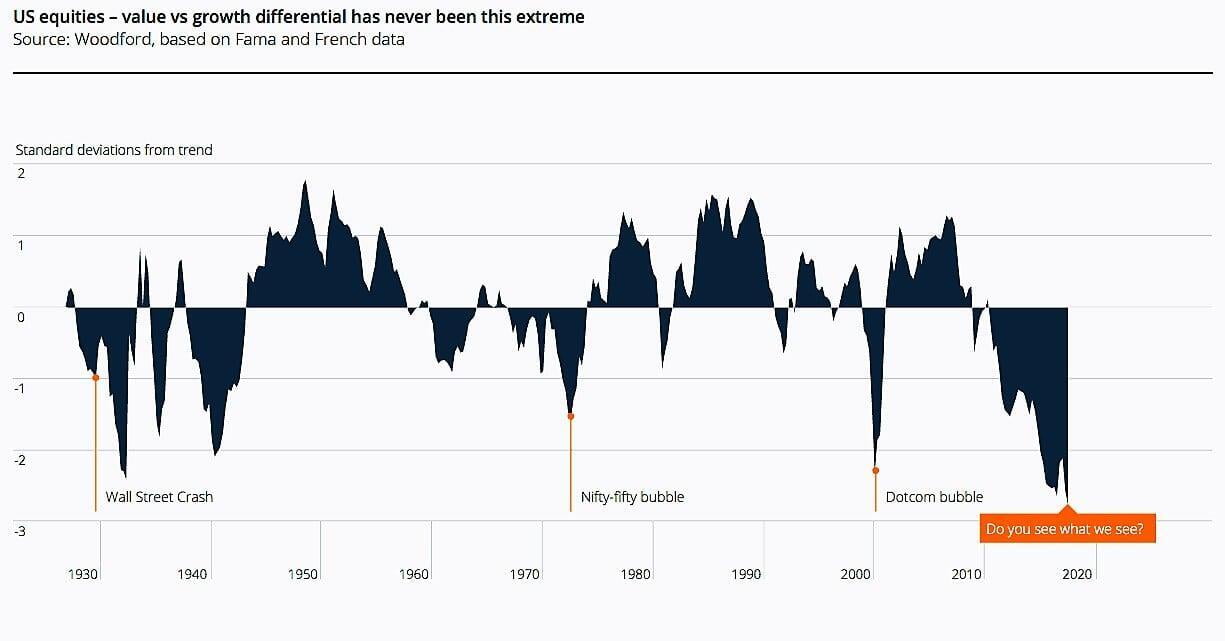

So, when will this trend of Growth stocks outperforming Value stocks reverse? As always, timing the market is notoriously difficult, if not impossible. It could be a matter of weeks, months, or even years, but given that we are investing to fulfill the longer-term financial goals of our clients, it’s best to get ahead of this trade now to avoid missing out. It’s also worth noting that when this trend reverses, the outperformance of Value could be significant, given how extreme the deviation has been as seen in the chart below.

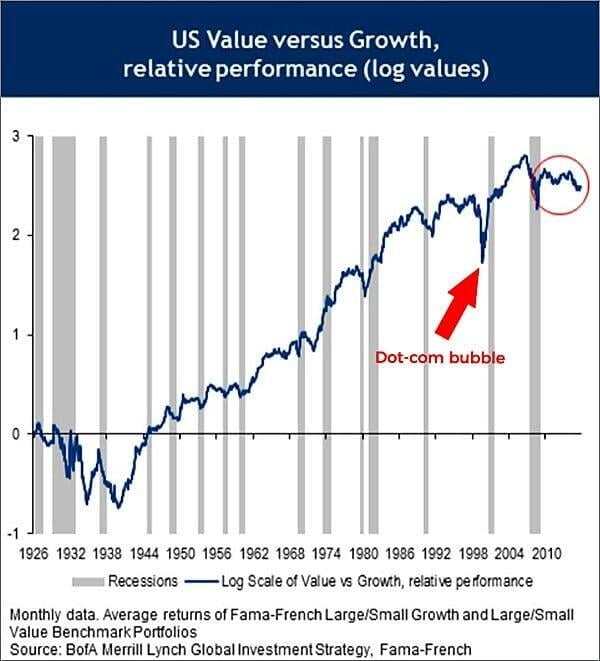

The final benefit of owning Value stocks is that they tend to outperform over the long-term due to human psychology and behavioral finance. The reason is that Value stocks are boring. They tend not to be cutting edge and they sell at a discount because they often face challenges.

Tesla is sexy, people want to own it because it’s exciting and they are willing to ignore fundamentals and often overpay for it.

Take Ford (Value) vs Tesla (Growth) as an example. Ford sold around six million vehicles last year and is extremely profitable. Meanwhile, Tesla is on pace to produce about 250,000 vehicles and has never turned a profit, yet it has a higher market value than Ford. If you ask Tesla investors why they own it, they don’t talk about financials, they talk about the future of electric cars, and how it’s more than just a car company. This includes self-driving technology, batteries and solar to name a few. They’re not wrong, but they do prove my point. Tesla is sexy, people want to own it because it’s exciting and they are willing to ignore fundamentals and often overpay for it. This is indicative of so many Growth stocks and is why over the very long-term Value has outperformed, see chart below.

To summarize, the core tenants of Value investing are currently underappreciated and stand to benefit from the following:

- Mean reversion following a decade of underperformance

- Low valuations relative to Growth stocks currently

- Rising interest rates forcing investors to refocus on the fundamentals

- Consistent overpricing of Growth stocks due to behavioral bias

So, how are we positioning our client portfolio's in this environment? Well, we have reduced our allocation to US equities, due to their high valuations and overexposure to Growth stocks. We have offset this by purchasing the Vanguard Global Value ETF, which uses quantitative models to identify Value stocks and invest in them at a low cost. This strategy has nearly 60% in US equities, which helps us maintain an appropriate exposure to the US market, but eliminates companies with excessive valuations.

As always, we do not receive any compensation or commission for owning or recommending specific strategies, so our incentive is to use strategies that we believe will provide the highest risk-adjusted returns, net of fees and taxes.

Sources:

https://blogs.cfainstitute.org/investor/2018/08/09/growth-vs-value-waiting-for-godot/

https://www.valuewalk.com/2018/02/performance-differential-growth-stocks-value-stocks-now-greater-time-history/

https://www.vanguardcanada.ca/individual/indv/en/product.html#/fundDetail/etf/portId=9795/assetCode=equity/?overview