Devalue the Dollar: USD in Long-Term Decline

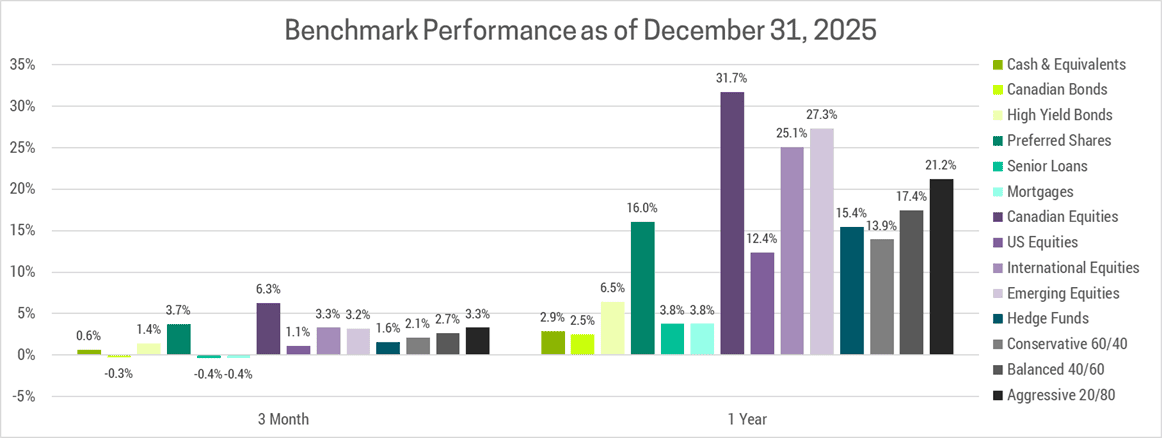

Markets continued their ascent in Q4 to cap off another great year. Every major asset class was up, with equities leading the way. Our client portfolios outperformed significantly as nearly every one of our overweight/underweight calls proved correct. Most impactful was our equity overweight and corresponding underweight in bonds. We expect markets will face more headwinds this year from high expectations/valuations, geopolitical tensions (Venezuela and the rise of U.S. imperialism) and rising inflation spoiling market expectations for further rate cuts. As a result, we took the opportunity last week to trim our equity exposure back to neutral.

If you were to only focus on the headlines, you might be shocked to see how well markets have done. Here is just a taste of what markets faced in 2025:

- U.S. tariffs reached their highest levels since the great depression

- China slapped export restrictions on rare earth elements, a key component in modern high-tech applications for which they control 90% of refining and processing

- The longest U.S. government shutdown in history

- Safe-haven demand for gold pushed prices to record highs

Investors may also be surprised to learn that the U.S. underperformed significantly in 2025, despite the growth in AI. A big reason for this is a ~10% drop in the USD, relative to a trade weighted basket of global currencies. Market performance is often shown in local currency, but we need to compare apples to apples so returns need to be converted into a common currency.

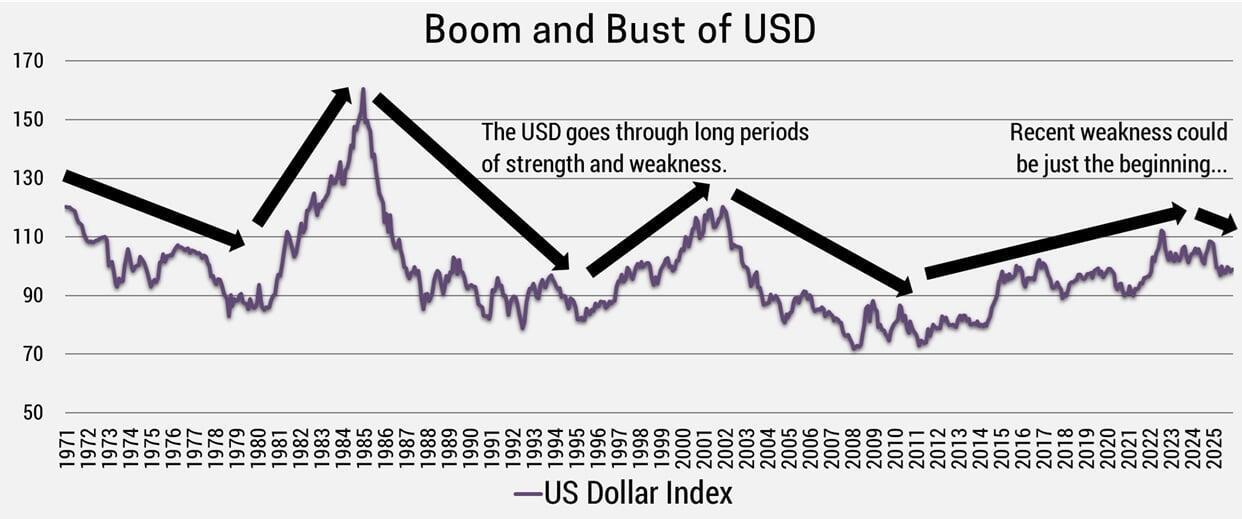

This USD weakness is a trend we believe will continue in the years ahead. Its value tends to move in long-term cycles and there are fundamental changes taking place that set the stage for an extended period of decline. We’ll discuss this in-depth throughout the remainder of this newsletter. The rationale builds on the topics we discussed in our last two quarterly newsletters. If you haven’t already read those, I recommend doing so, but I’ll summarize the key points.

THE DEBT TRAP IS CLOSING

Trump's "big, beautiful bill" has fundamentally worsened America's already unsustainable fiscal trajectory. The arithmetic is clear, permanent tax cuts combined with expanded defense and immigration spending far exceeds the savings from cutting green subsidies and welfare programs. As a result, U.S. deficits are all but guaranteed to grow.

This comes as national debt now exceeds $38 trillion or 124% of GDP, with interest payments now one of the fastest-growing line items in the federal budget. Given how unsustainable this trajectory has become, we believe it's only a matter of time before bondholders revolt. When that happens, a dangerous feedback loop kicks in:

- Larger deficits force more debt issuance

- Investors demand higher yields to compensate for inflation and default risk

- Higher borrowing costs create even larger deficits

- Investor confidence erodes pushing rates higher still

We're watching the 10-year U.S. Treasury yield closely as a spike above 5% would be a strong signal that markets share our concerns, likely resulting in a broad based market selloff.

INFLATION ISN'T GOING AWAY

Despite what the Fed seems to believe, inflation is proving far stickier than expected. Core measures have plateaued well above the 2% target and are showing signs of edging higher rather than declining. The pipeline for future price increases looks concerning, with multiple inflationary forces at play including re-shoring production, persistent fiscal deficits, tariffs working through the system, a weakening dollar and deportations shrinking the labor pool.

U.S. consumer inflation expectations for the next 5 years are above 3%. If this persists, it becomes a self-fulfilling prophecy as workers demand wage hikes to keep up with rising prices. The only way out becomes a recession, which we view as unlikely barring some major economic shock.

INTEREST RATES ARE TOO LOW

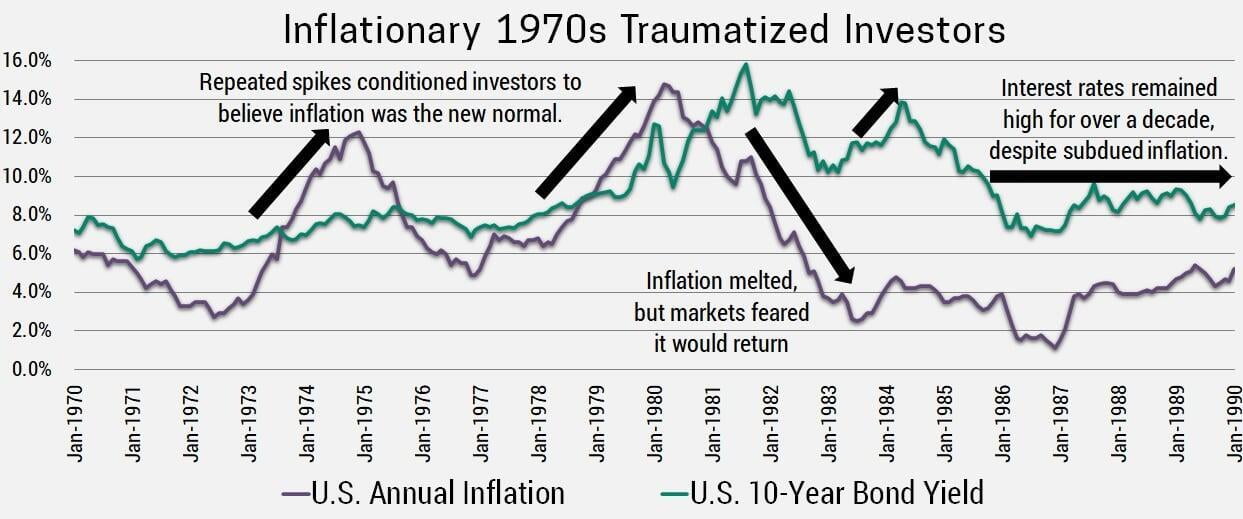

Monetary policy isn't actually restrictive at current levels. If it was, the U.S. economy wouldn’t have sustained strong 2%+ real growth and equity markets wouldn’t be at all-time highs. Despite this, the Fed remains biased towards rate cuts. This echo’s history but in reverse. In the 1980s, even after Paul Volcker crushed inflation by triggering two deep recessions, interest rates remained elevated for years. The 1970s had taught investors that inflation was always lurking.

Today, the 2010s have instilled the opposite belief, that deflation is the natural state. As such, we expect the Fed will consistently underestimate inflation risks and keep interest rates far too low. Coupled with massive fiscal stimulus through ongoing deficits and rising import costs due to tariffs and a 10%+ USD decline means inflation risks are rising. Immigration restrictions are reducing labor force growth, so the labor market should continue exerting upward pressure on prices rather than providing justification for additional Fed rate cuts.

FED INDEPENDENCE WILL BE TESTED

The Fed has clearly lost its way, the question to be answered is whether it will also lose its independence. Trump wants lower interest rates to reduce the cost of financing ongoing deficits, so when Powell’s term ends on May 15, 2026 he is likely to be replaced by a more compliant Fed chair. This could undermine investor trust in U.S. monetary policy.

If the Fed is cutting rates while the economy is strong and inflation is above target, investors will start to demand more interest to compensate for rising inflation risks. In other words, they won’t be willing to buy a U.S. 10-year bond at the current 4.2% yield when inflation is above 3% and rising! So long-term bond yields will have to rise in order to attract buyers at the same time that short-term yields are being held artificially low by the Fed.

Most likely a chaotic rise in long-term yields will cause the Fed to pivot and hike rates again, but there’s also a chance they will fight back. The Fed could become the buyer of last resort for long-term U.S. government debt, to keep yields from rising. This could be financed by issuing additional short-term debt, where they are able to keep rates low. This is what central banks across the world did following the 2008 financial crisis, to keep borrowing rates down and stimulate growth. But in the current environment where growth and inflation are high, it can only be sustained for a little while.

As more long-term debt is paid off with short-term debt, the U.S. government becomes ever more reliant on keeping short-term rates low. Typically, governments are able to stave off a debt crisis because the majority of their borrowing is locked-in at long-term rates. This is why the 2022 spike in interest rates had a limited impact on governments, they only have to refinance a small portion of their debt each year. If all your debt is short-term, you have to continue to find new borrowers every year, and any increase in interest rates is felt immediately. As U.S. debt balloons due to ongoing massive deficits, this dramatically increases the risk of a future debt crisis in the U.S.

USD IN LONG-TERM DECLINE

Currencies are like goods, their price depends on supply and demand. If interest rates are held artificially low, there will be less demand for U.S. debt. With less foreign investors buying U.S. debt there is also less demand for the USD. Meanwhile, the supply of USD is rising as the Fed issues more bonds to finance growing deficits. While the USD does tend to gain strength during a crisis, as investors rush in for the perceived safety, our expectation for an ongoing economic expansion suggests further weakness ahead.

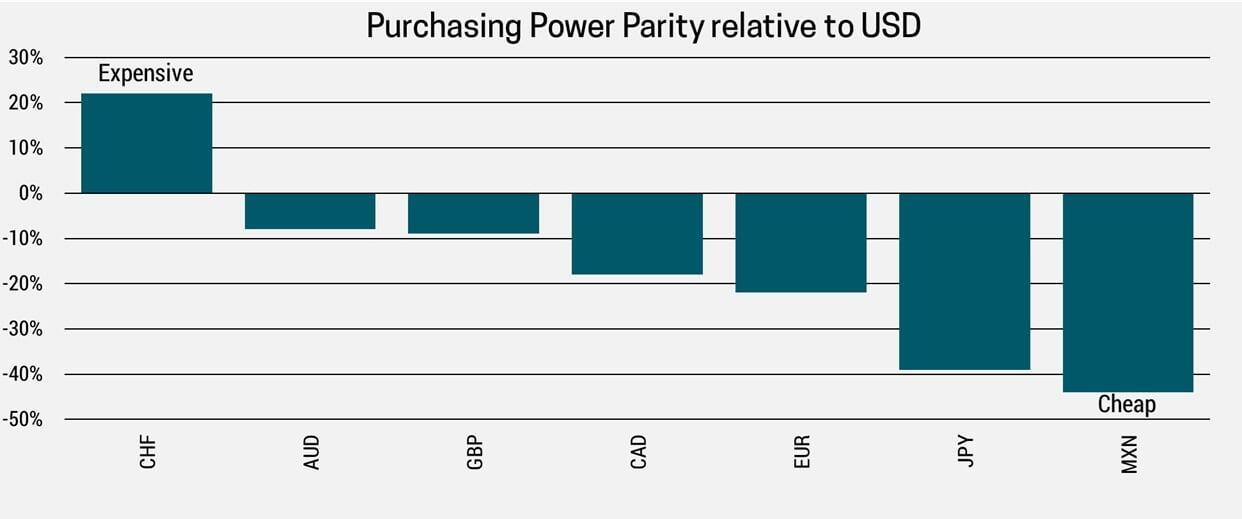

To make matters worse, the USD is still expensive, despite the 10% drop last year. Purchasing power parity measures the cost to buy a comparable basket of goods and services in different currencies. By this measure, the USD remains significantly more expensive than every other major currency except the Swiss Franc.

PORTFOLIO STRATEGY

Trimming our equity exposure to neutral shouldn’t be misconstrued as predicting an imminent sell-off. It simply reflects prudent portfolio management whereby we are taking some profits given the significant upside we’ve seen. We did this by trimming our U.S. bank exposure, as it allows us to further reduce our exposure to the USD. We still think U.S. banks will outperform the aggregate U.S. market, but believe there is more upside and less risk outside North America.

We also sold our global high yield ETF, which had over 50% of its exposure in the U.S. This further reduces exposure to rising interest rates in the U.S., which is likely if our concerns regarding inflation pan out. Our plan is to reinvest these proceeds in more defensive income generating strategies outside North America to benefit from expected currency appreciation, relative to the CAD and USD.

We continue to believe that staying invested in a diversified portfolio is the best approach, while avoiding assets with extreme valuations and high expectations. Specifically, we remain overweight Europe, Japan and emerging markets with a corresponding underweight in Canada and the U.S.