The holidays are approaching fast, which means spending quality time with family and friends. If your family’s anything like mine, the markets are an inevitable subject of conversation. As such, I wanted to provide some investment commentary early so you can be well informed should the topic come up.

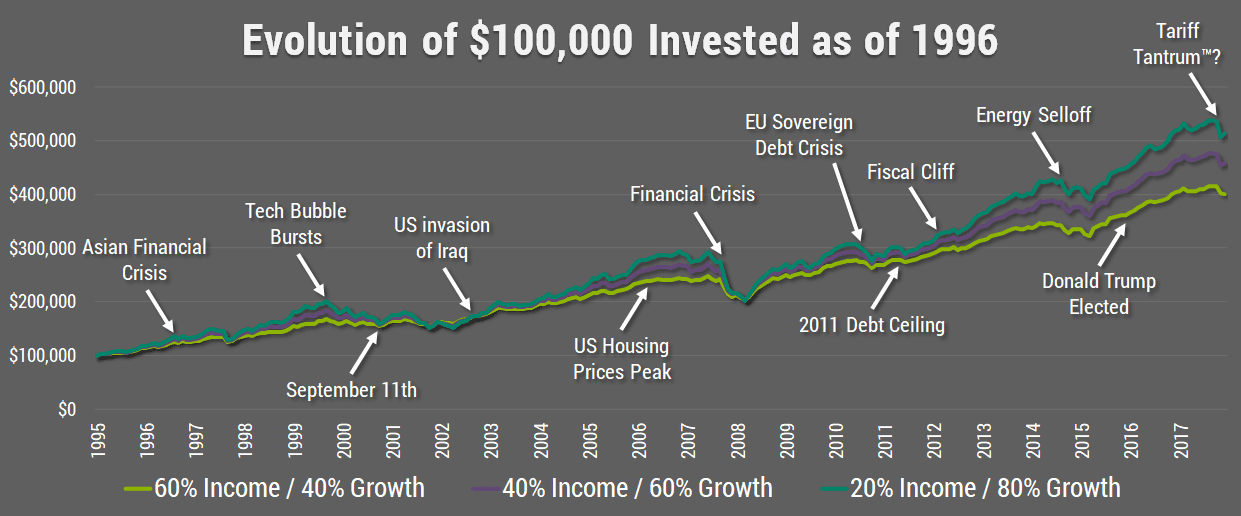

2018 has been a difficult year for investors, with trade disputes/tariffs, rising interest rates, high debt loads, collapsing crude prices, and more. At times like these, it’s easy to contemplate throwing in the towel and going to cash, but as the chart below shows, historically a diversified portfolio has performed extremely well over time despite the plethora of market events that have taken place.

I think it's fair to say all these events were significant and felt like a good time to sell, but only a few were correct. Even if you got that sell timing right, going to cash would only have benefited you if you had the courage to buy the dip. This is much easier said than done, as when markets fall the expectation is that they will fall further. Perhaps that is the case now, or perhaps this is similar to the EU debt crisis or energy sell-off and markets will resume their 10-year march higher.

Based on our analysis of the underlying economic data, we believe we are in the late stages of this cycle. This position is supported by some significant macroeconomic trends below:

- Low unemployment rates are leading to wage growth, and rising consumer confidence

- Inflation is rising leading to a corresponding uptick in interest rates

- Yield curves are flattening

- Corporate profit margins and EPS growth are high, but the rate of growth has begun to decline

- Developed market existing home sales are beginning to decline

- US Manufacturing is near peak capacity utilization

- Global Manufacturing PMI is declining, but still in expansionary territory

In short, while there are signs the economy is slowing, we do not believe a recession is imminent. The Federal Reserve seems to share our view as they raised rates yesterday and are forecasting 2 more rate hikes in 2019. This clearly shows they do not expect a recession until at least 2020, a viewpoint they justified as follows, "The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term”.

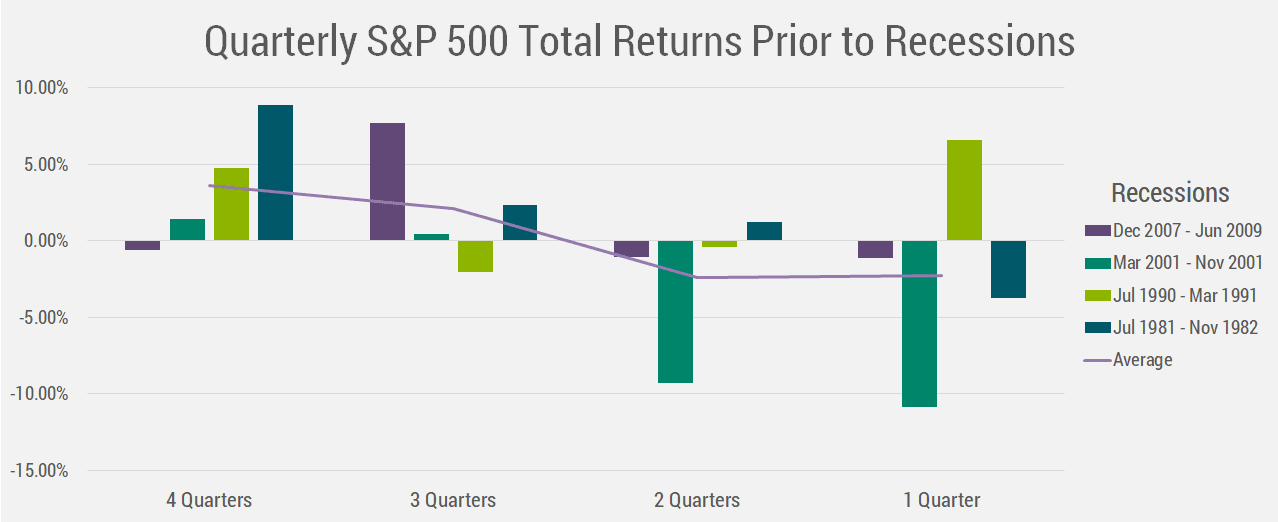

Put simply, we (and the Fed) expect a recession is coming, just not yet. So how should investors position their portfolio in this environment? Well, it’s nearly impossible to predict the timing of the next recession but given that we are likely in the late-cycle, most individuals instinct is to sell stocks now, hold cash and wait it out. Unfortunately, as the chart below shows, equity returns tend to be strong in the late stages of the business cycle, particularly 7-12 months prior to a recession. Our base case is that we will have a recession in 2020, and as such we believe it is prudent to maintain equity exposure to reap potentially strong late-cycle returns.

Another way to look at this is to consider what you’re giving up by holding cash. Currently cash is yielding around 2%. Meanwhile, our balanced portfolios with 60% Growth and 40% Income provides a 3.5% yield through dividends and interest alone, plus another 2.5% through retained earnings (15X Price/Earnings multiple, less 2.5% dividend yield, on stocks which make up 60% of the portfolio = 0.6*(1/15 – 0.025)). So, our balanced portfolios should generate a 6% return on investment based on the fundamentals today and this doesn’t even include earnings growth, which was 8.5% last year.

We acknowledge there are significant risks in this forecast, but as a fundamental, evidence-based portfolio manager, we believe this potential upside more than compensates investors for the risk they are taking.