Stimulus, Elections and COVID-19

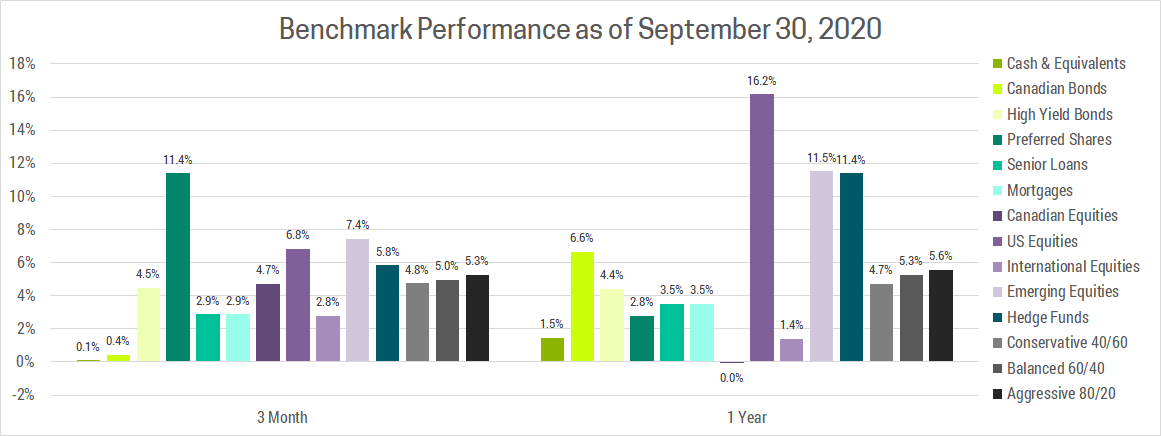

Markets climbed ever higher in Q3 on the back of ongoing monetary and fiscal stimulus from central banks and governments. Balanced portfolios saw gains in the mid single digits as every asset class posted positive returns for the quarter.

While returns since markets bottomed in March have been significantly larger and faster than most investors anticipated, as mentioned in our mid-August update we are beginning to see cracks form in the recovery. Specifically, we highlighted rising case numbers, which have accelerated further, and the US congress gridlock regarding additional stimulus. Furthermore, with the election approaching US politics are more divisive than ever, highlighted Tuesday when Trump halted further stimulus negotiations until after the election. In short, the risks we identified remain unresolved and have only escalated further. Markets have held up remarkably well despite these issues, but we continue to preach caution over the short-term.

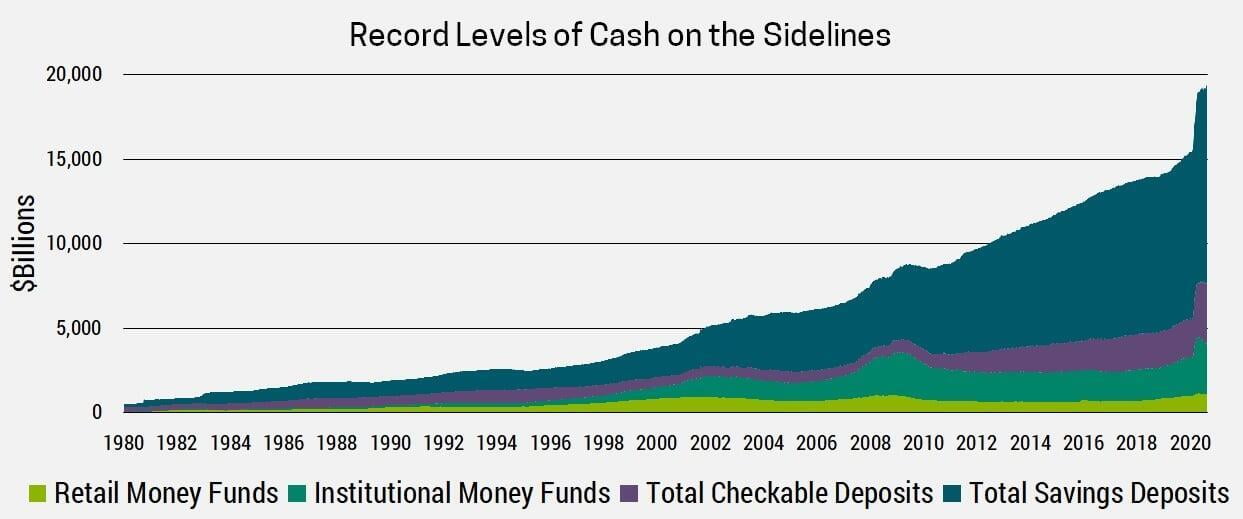

As mentioned in August, we reduced the risk exposure of our portfolios by adding gold producers and have allowed cash from dividends and interest to accumulate in portfolios. If the pullback we are expecting materializes, or the issues we have identified are resolved, we plan to get more aggressive as we continue to favour equities over bonds in the medium to long-term. Any sell-off will likely be short-lived as it would put pressure on politicians to further increase fiscal stimulus. Furthermore, investors are sitting on record high cash balances making them more likely to buy the dip.

US ELECTION

Odds now favor a Democratic (Biden) victory in the US, which puts Trump’s corporate tax cut at risk. Real-estate, tech and health care have the lowest effective tax rates currently, so tax increases are most likely to target them as well as high income earners. Markets will not like this at first, but additional tax revenue is likely to be reinvested into the economy, which nets out the impact. After all, in negotiations over renewed stimulus it was the Democrats who initially proposed $3.4 trillion of additional spending, roughly triple what the Republicans initially offered.

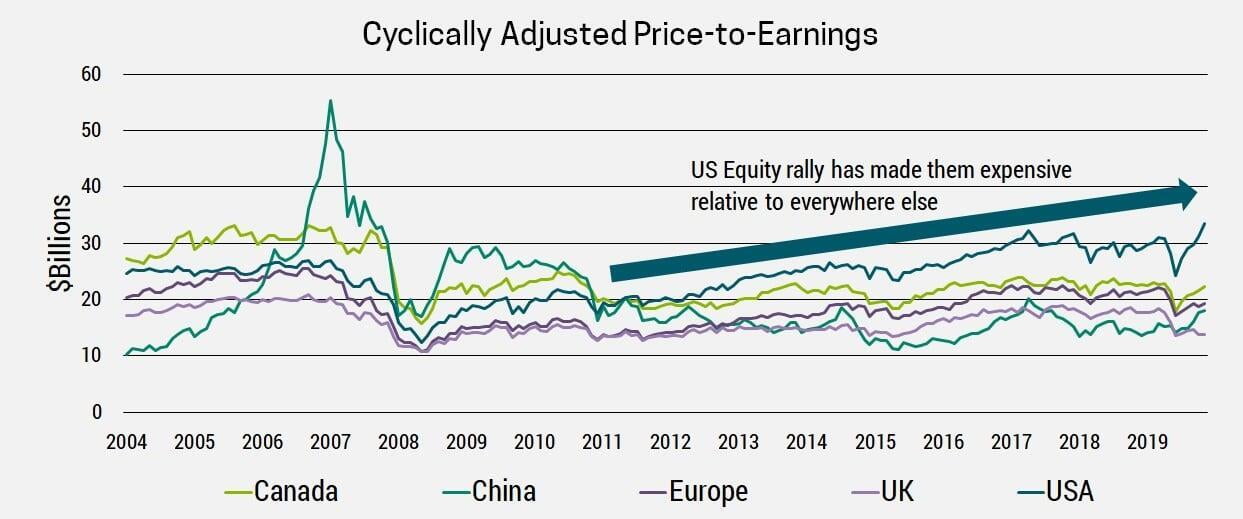

Any additional stimulus would boost the economy and asset prices while putting downward pressure on the US dollar (USD). This benefits markets globally, particularly emerging markets with significant USD denominated debt. Furthermore, democrats would be less likely to pursue trade wars, boosting emerging markets further. All this means more money flowing outside the US, which coupled with lower valuations outside the US makes International and Emerging equities extremely attractive over the medium to long-term, see chart below.

Democrats would also be negative for health-care stocks, hurting their pricing power with Obamacare era reforms (especially if they sweep all three branches of government). Republicans have also spoken of reducing drug costs so pharmaceuticals could suffer even if Republicans hold onto one branch of government. Tech is likely to experience renewed regulatory and anti-trust pressure regardless of which party wins due to wide profit margins and growing market power.

Lastly, we expect corporate margins will compress going forward, regardless of which party wins the election. Wage compensation as a percentage of GDP was at all time highs in the 70s. Now corporate profit as a percentage of GDP is at an all time high. Eventually this pendulum must swing back in favor of wages, a trend that would likely be accelerated, if as current polls suggest, the democrats sweep all three branches of government.

COVID-19

We are already seeing a second wave, and while this will put downward pressure on markets, we do not expect the reaction to be as severe as the first wave even if case numbers go significantly higher. After all, this time health care systems are better prepared with multiple treatments and our understanding of the virus and how it spreads is significantly improved.

If you have ever watched a horror film, the monster is always scariest at the beginning, when you don’t know what it is. Therefore, we are unlikely to experience the widespread fear and panic we saw in March.

There can be no economic health without public health. Countries who have done better handling the crisis have seen a faster economic rebound. This does not correlate perfectly with market performance, leaving relative opportunities for savvy investors. While managing the spread is the ideal scenario, our base case remains for a safe and effective vaccine to be developed, approved and widely distributed by summer 2021. As such, markets may shrug off rising case numbers as they price in a return to normalcy on the back of a vaccine.

While the pandemic will eventually come to an end, we have identified several trends we believe will persist long after, including:

- Rural Resurgence: De-globalization and remote work could result in urban dwellers moving into suburban and rural settings. This has huge implications for real-estate prices.

- Shift to online: Whether it’s work, videoconferencing, online shopping, entertainment, or just about anything else we’ve all been forced online during the pandemic and many of these trends will stick.

- Automation: As companies’ revenue declines, they have been forced to cut costs by investing more in technology.

- Resiliency over Efficiency: Supply chains imploded at the outset of the pandemic as entire economies shut down. Now companies are focusing on the resiliency of supply chains as opposed to their efficiency. This means larger inventories, multiple suppliers, buying local and a commensurate increase in costs.

- Central Bank and Government Intervention: We used to call it the “free market”, but now we’ve seen large-scale monetary and fiscal interventions during the 2008 financial crisis and pandemic. These have proved remarkably effective so we expect governments and central banks will continue to intervene in times of crisis resulting in less volatility and shorter market corrections going forward. The unintended consequence could be lower long-term returns as inefficient companies who would typically go bankrupt during a recession are propped up.

CENTRAL BANKS AND INFLATION

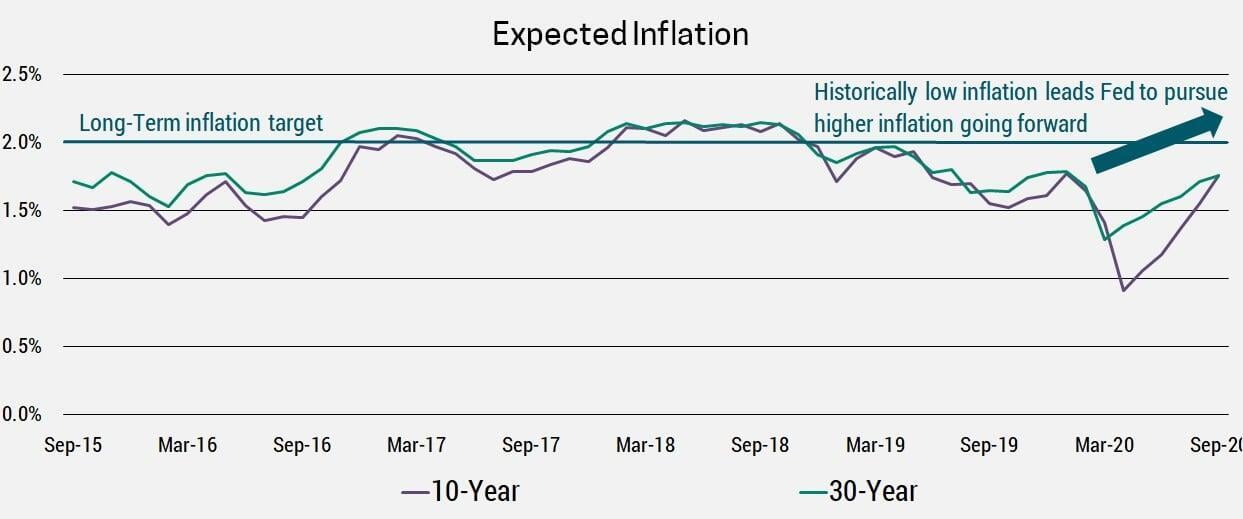

Stimulus during the pandemic is roughly triple what we saw in 2008 and it’s going directly to households. This leads to consumer spending, which pushes up prices, whereas 2008 stimulus went to and stayed within the financial industry. This is why inflation is far more likely this time. While central banks would typically raise interest rates when signs of inflation appear, massive government debt makes this politically unfavorable as it would result in a larger share of spending going to interest payments. Furthermore, the Fed has adjusted their inflation goal towards keeping average long-term inflation around 2%. This means that periods where inflation is below 2% (as it has been for several years now), will allow the Fed to pursue above average inflation in the coming years (perhaps 3-4% will be tolerated). If inflation rises significantly higher central banks would be forced to act. Fortunately, this is unlikely to happen for many years, but when it does this will likely signal the end of a bull market.

To counteract these inflationary pressures, baby boomers begin retiring en-mass this decade. They will be living on fixed income’s, and with low interest rates this would force a reduction in spending. While there is some truth in this, we believe its effects are overblown. Some have also suggested that technology will allow us to produce more for less, thus resulting in deflation, but we have actually seen low real productivity growth. Perhaps these rationales explain why the market has not taken inflation seriously, as seen in the chart below.

INVESTMENT IMPLICATIONS

We continue to favour equities over bonds as ongoing monetary and fiscal stimulus supports asset prices. However, in the near-term we do have some concerns (which we have discussed) and many years from now we may become more defensive as central banks are forced to tame rising inflation. In short, our market views parallel the story of goldilocks and the three bears. Our short-term market outlook is too cold. Our long-term outlook shows markets getting too hot, but the medium term is just right. With this in mind, we’ve highlighted some of the key strategies we’ve employed for the medium term across our client portfolios:

- Overweight Equities vs Bonds: There is plenty of cash on the sidelines waiting to be invested. Equities may not be cheap, but relative to bonds they are.

- Overweight Cyclicals vs Defensives: Most of the strength so far in the equity rebound has been defensive sectors like tech and healthcare. Not much of the rebound has been priced into cyclicals yet. Furthermore, China’s massive reflationary policies are a key driver of commodity prices going forward.

- Favor Value vs Growth: Growth has been driven by Tech and Healthcare, but this strength is already priced in. Meanwhile, the regulatory environment is likely to become less favorable to them. Furthermore, growth stocks have benefited from declining yields, which increase present value calculations for long-term earnings growth. With interest rates on the floor there is nowhere to go but up, which will hurt growth stocks.

- Rotate into Non-US Equities: USD weakness supports commodity prices and emerging markets who benefit from stronger demographic trends and cheaper valuations.

- Inflation Hedge: As Inflation inches higher there will be political pressure on central banks not to raise interest rates due to high public sector debt. This means Inflation will likely be allowed to move above target. As such, investors should own hard assets, gold, value stocks and short-term debt, all if which perform relatively better during periods of higher inflation.

One final note to those holding excess cash due to all this market uncertainty: uncertainty declines as your holding period increases.