Trump’s “Big, Beautiful Bill”: A Fiscal Reckoning in the Making

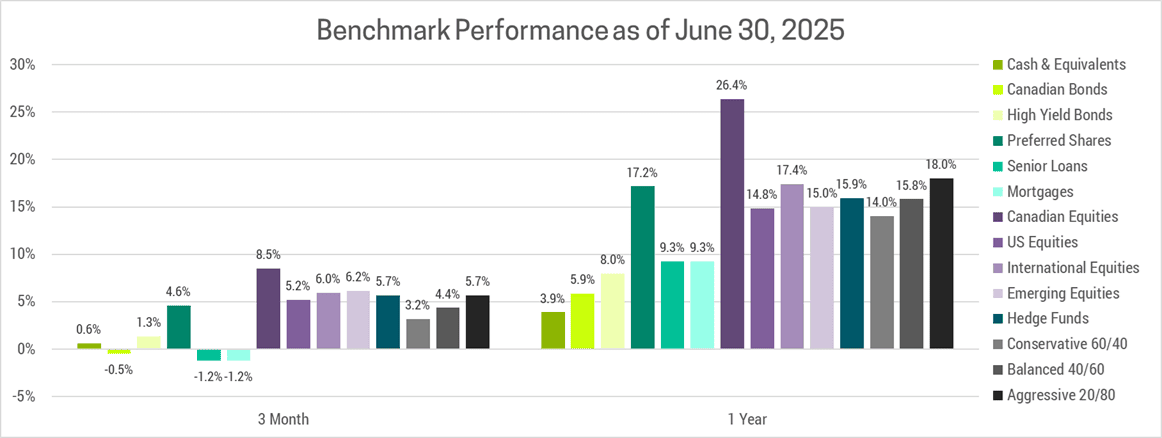

Markets suffered double digit losses following the liberation day tariff announcement. A week later, Trump pivoted by announcing a 90 day pause. Since then, markets haven’t looked back, recovering all their losses and ending the quarter with significant gains across most major asset classes. We’re particularly pleased with the performance of our portfolios, which continued to outperform the benchmark.

TARIFF UNCERTAINTY

As we said in our Q1 newsletter, while markets were panicking over tariffs, our base case assumption was that Trump would “de-escalate, as he did in 2018 when his trade war with China risked sending the global economy into a recession”. Now that this happened again, markets are even more confident that Trump will always back down. While this is still the most likely outcome, it is far from guaranteed. Trump’s focus lately has been on passing his “big, beautiful bill”. With this complete, he may shift his focus back to tariffs, believing the economy is now in a better position to weather the storm.

Additional government spending, tax cuts, a calming stock/bond market, falling inflation and the possibility of Fed rate cuts would provide an economic buffer for Trump to re-escalate tariff threats. Given Trump’s inherent unpredictability, we believe the most prudent strategy is to avoid investments that are highly dependent on trade with the U.S. This is why our U.S. exposure is through banks, which don’t import or export goods. This allows us to shift our focus to the long-term, which is where the “big, beautiful bill” has worsened America’s already unsustainable fiscal trajectory.

SHORT-TERM GAIN, LONG-TERM PAIN

The bill cements Trump-era tax cuts well into the future, locking in structurally lower federal revenues over the coming decade. At the same time, it significantly expands spending on defense and immigration enforcement. These priorities are partially offset by cuts to green subsidies and reductions in healthcare and welfare spending targeted at lower-income Americans. But the arithmetic is clear, the savings fall far short of covering the costs.

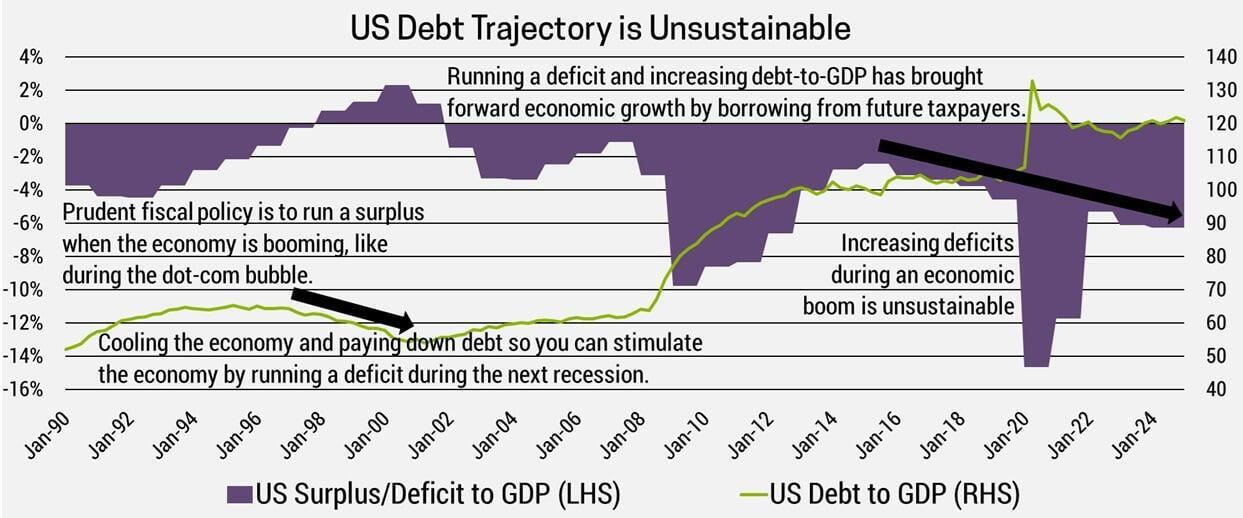

As a result, the U.S. deficit is all but guaranteed to grow. This comes as the U.S. national debt crosses $36 trillion, or 120% of their GDP. Interest payments are now one of the fastest-growing line items in the federal budget. With deficits projected to remain well above pre-pandemic norms, the U.S. government is increasingly reliant on favorable borrowing conditions to remain solvent. Given how unsustainable the U.S. debt trajectory has become, we believe it’s only a matter of time before bond holder’s revolt.

U.S. INFLATION WILL SPOIL THE PARTY

As we’ve discussed before, we believe that inflation will be structurally higher in the decade ahead. Globalization allowed businesses to offshore production to cheaper jurisdictions and has helped keep prices low. The pandemic exposed the risks of global supply chains and kicked off a push to re-shore production, a trend that gained further urgency following Trump’s liberation day tariffs. The U.S. is likely to experience the most inflationary pressure of any developed nations due to their persistent and rising fiscal deficits, stronger relative economic growth, tariffs and a weakening USD.

The USD faces multiple headwinds: it's counter-cyclical (investors leave it as fear subsides), still overvalued despite the 10% year-to-date drop (the steepest decline since 1973), and losing its reserve currency status due to years of isolationism and a declining share of global trade. A weaker USD and tariffs both increase the cost of imports, while deportations and slowing immigration shrink the labour pool putting upward pressure on wages and increasing production costs. Tax cuts also boost inflation as it puts more money in consumers pockets, that they can spend and push up the prices of goods and services.

Inflation may come down in the short-term as elevated policy uncertainty has caused consumers and companies to curtail spending. This could allow the Fed to cut rates, but ultimately this should prove temporary. Despite recent declines, inflation remains elevated compared to pre-pandemic norms, with core US CPI steady around 2.8%. Consumer long-term inflation expectations reached 4.1% in May, the highest since 1993. If this persists, it may become a self-fulfilling prophecy as workers demand wage hikes to keep up with perceived price increases. The only way out then becomes a recession, which we view as unlikely barring some major economic shock.

FED INDEPENDENCE

Markets still anticipate several rate cuts over the next 12 to 18 months. If inflation proves sticky as we expect, the Federal Reserve will have far less room to ease than investors hope. A re-acceleration in inflation could even push the Fed back into tightening mode by 2026. But what if the Fed losses independence and decides to cut rates despite consistently higher inflation?

There is political pressure building. Trump has openly criticized Fed Chair Powell in the past and has signaled he would prefer a more compliant Fed. He could appoint a “Yes Man” when Powell’s term ends on May 15, 2026, or announce his future replacement earlier which would undermine Powell in the interim. This loss of Fed independence would undermine investor trust in U.S. monetary policy. If investors begin to doubt the Fed’s commitment to fighting inflation, then long-term Treasury yields could rise sharply.

If this were to happen quickly, we suspect Trump would pivot and appoint someone more market friendly. As we saw in April, Trump isn’t willing to accept significant market sell-offs or volatility, especially when it’s the result of a decision he made that can be easily reversed. That’s why the bigger risk is the unsustainable long-term US fiscal trajectory.

DEBT FEEDBACK LOOPS

If investors begin to doubt the government’s ability to manage its debt, that kicks off a dangerous feedback loop:

- Larger deficits push up debt issuance.

- Investors demand higher yields to compensate for inflation, default and political risk.

- Higher borrowing costs feed into even larger deficits.

- Investor confidence erodes and less buyers pushes rates higher still.

This can escalate rapidly, as we saw following Liz Truss’s disastrous 2022 mini-budget which spiked UK yields and cratered the Pound before they reversed course 10 days later (and forced Liz Truss to resign). It can also be delayed for decades, as is the case with Japan, which has total debt to GDP exceeding 250%! The reason this hasn’t become a crisis yet is due to low (previously negative) interest rates, which makes debt servicing costs manageable. It can be hard to predict exactly when a country will face a debt crisis, but we believe it’s a combination of 3 factors:

- Total Debt to GDP: The higher a governments debt, relative to the size of their economy, the greater the risk. U.S. debt is high, but still manageable, at least for now…

- Deficit Trajectory: It’s not just the level of debt that matters, but how fast you’re accumulating it. This is where the U.S. is in trouble, as we discussed in this newsletter.

- Interest Rates: The higher the interest rate, the more expensive it is to service the debt. Inflation is usually what forces interest rates higher and is a key concern for the U.S.

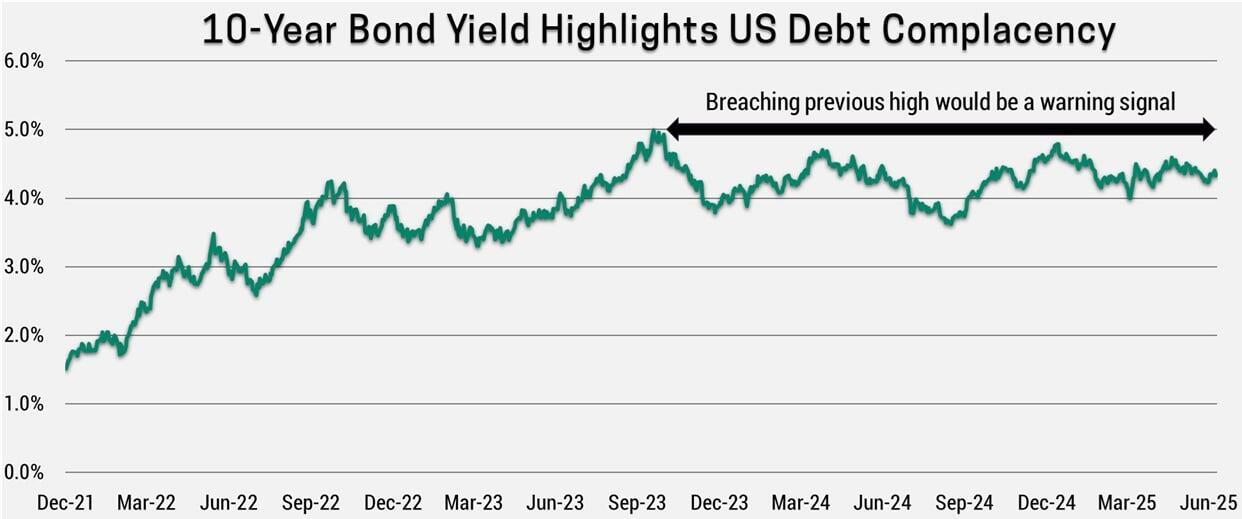

A debt crisis could be years or even decades away, but a key catalyst we’re watching out for is rising long-term U.S. Treasury bonds. Specifically, if the 10-year yield spikes above 5% this would be a strong signal that markets are concerned about this and would warrant getting more defensive with our investments.

PORTFOLIO STRATEGY

The U.S. government is moving toward a major expansion in spending. This push means even wider budget deficits, which would juice near-term growth. If Trump doesn’t re-escalate tariff threats, then the recent pause in consumer and business spending will end causing economic growth to re-accelerate in the short-term. This could kick off an economic boom, at least temporarily.

As we’ve discussed in this newsletter, the bill raises uncomfortable questions about debt sustainability over the long-term. With yields currently well below their previous highs, bond markets are signaling that they’re not overly concerned about inflation or the U.S. budget deficit. So long as this remains the case, both equity and bond markets should perform well.

We believe the best strategy is to stay invested, albeit with an overweight in International and Emerging markets which offer better value and lower policy risk. Their cheaper currencies are poised to appreciate, as investors diversify outside the U.S., which would boost returns further. On the Income side of portfolios, we’re avoiding long-term bonds which are at risk due to persistent government fiscal irresponsibility. This is particularly true in the U.S., which is the current poster child for fiscally irresponsible governance, but they are far from the only ones. When markets shift their focus to this, there will be a payback period, just not yet.