Avoid Bonds and US Equities

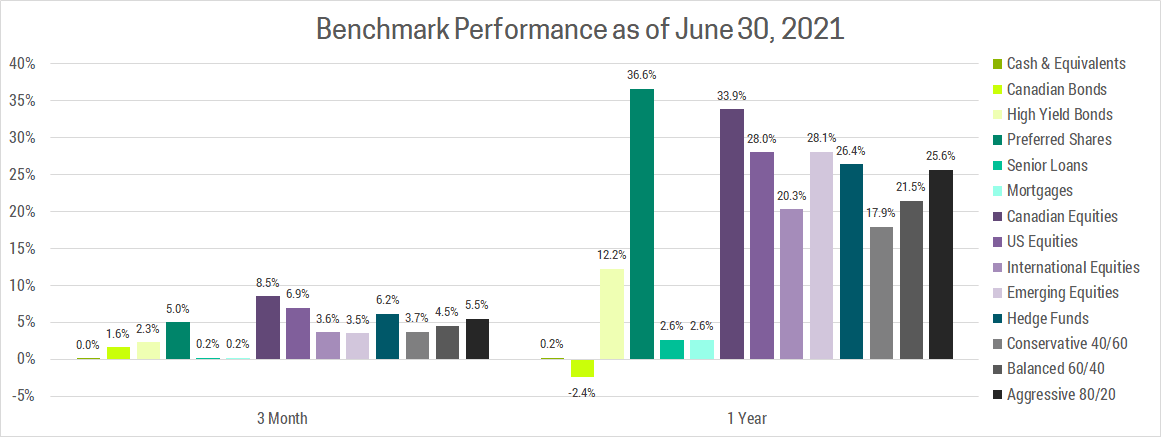

This past quarter saw markets continue to grind higher, with Canadian equities leading the way. The narrative we’ve held since March 2020, that vaccines and record stimulus from governments and central banks would lead to a broad based recovery, continues to take shape. Identifying these forces early and positioning client portfolios appropriately has allowed us to outperform the benchmark by nearly 10% on balanced portfolios since the March 2020 lows.

At this point, markets have priced in much of the good news. To see continued upside, companies will need to outperform already lofty expectations. We believe this is possible in underappreciated sectors including energy and financials, and regions including emerging markets and the euro zone. Meanwhile, pandemic beneficiaries like technology are poised to underperform as much of their growth was pulled forward from the future. I’ve said this before, but it warrants repeating, “if you didn’t sign up for Netflix or Amazon Prime during a global pandemic, you’re likely not going to in the next few years”.

INFLATION TAKES CENTER STAGE

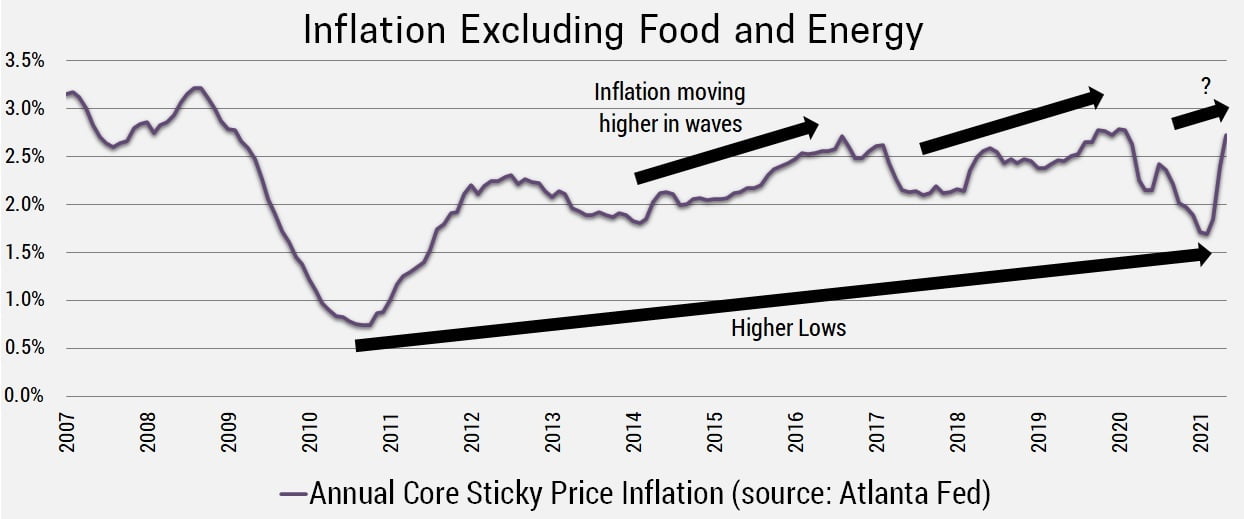

In our last quarterly commentary, we focused on rising inflation risks and the impact that has on interest rates, economies and markets. Since that time, inflation has accelerated dramatically, surprising markets and the Fed. The Fed now projects US interest rates to rise 0.5% in 2023, a full year earlier than they forecasted previously. Surprisingly, investors responded by bidding up prices for long-term bonds and interest rate sensitive assets like growth stocks. Their rationale, the current inflation spike is transitory and the earlier Fed interest rate hikes will be sufficient to prevent higher inflation. We disagree. Some of the current inflation spike is certainly transitory, a result of supply chain disruptions that will recede as economies reopen. That said, there are some key underlying trends that will result in higher inflation which we discussed in detail in the Q1 commentary.

THE FED IS COMPLACENT

While macro economic factors underpin our view of higher inflation, there are behavioral factors at play as well. After experiencing decades of below target inflation, markets and central banks have become complacent. This is best summed up by the following quote,

“The history of money reveals two highly reliable tendencies. Having recent experience of inflation, people cherish stable prices, and having long experience of stable prices, they become indifferent to the risk of inflation.” - John Kenneth Galbraith.

This complacency is misplaced, as a closer examination of last decade shows a clear underlying upturn for inflation. The pandemic acted as a short-term circuit breaker, but ultimately may enhance the rising inflation trend due to the sheer volume of stimulus that has been deployed.

VALUATIONS ARE ELEVATED

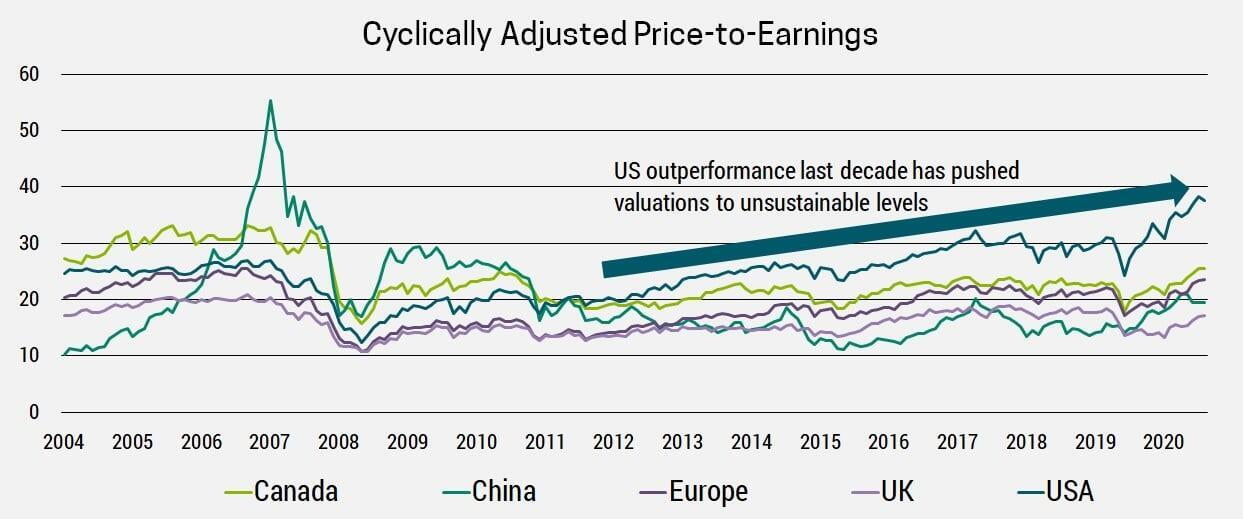

Almost every asset class is trading at, or above, their long-term average valuations. Some of this is due to higher expected growth rates, which is a reasonable assumption given that we’re exiting this crisis with household balance sheets in great shape due to record stimulus. The other factor is record low interest rates.

Investments are valued based on the cash flows they generate over time. Those cash flows that lie far into the future must be discounted back to the present. In the current low-interest rate environment, long-term earnings are worth more because they are discounted back at lower rates. Unfortunately, as the economic recovery continues and inflationary pressures build, interest rates are likely to rise. This effect will first be felt in the US, where a stronger economic recovery and inflationary pressures are already pushing interest rates higher. The result is exacerbated by higher starting valuations and elevated profitability.

NARROWING PROFITABILITY GAP

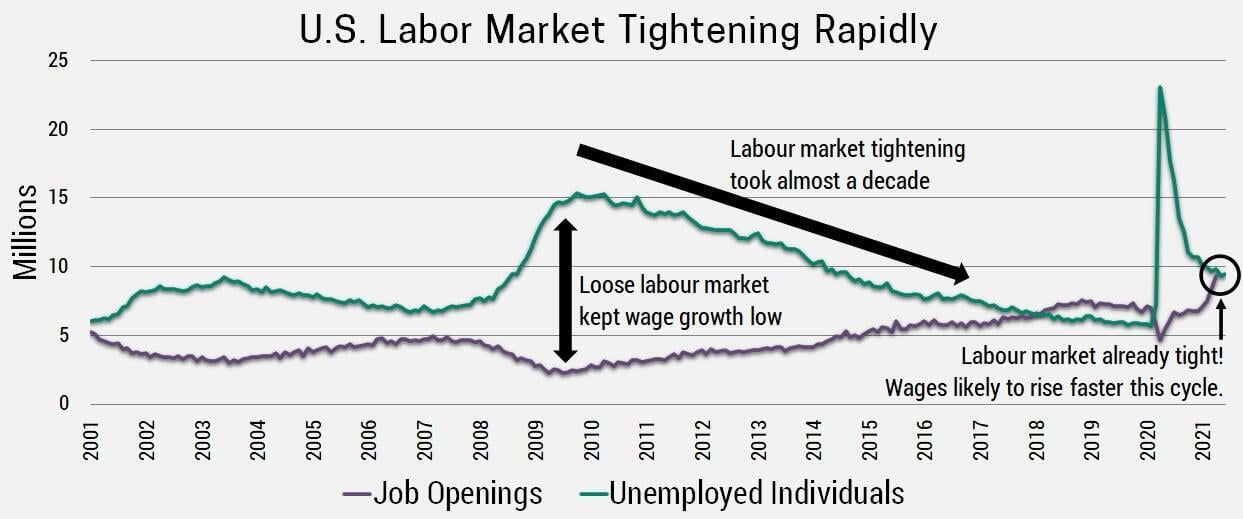

We believe the profitability (return on equity) gap between the US (16.9%) and rest of the world (12.5%) will narrow going forward. This is commonly the case, as anytime an industry earns an above average return on equity (eg. US Tech), they attract competition and regulation that ultimately reduces profitability. The reverse is true for low margin industries, where some companies go bankrupt leaving the survivors with better margins and market share. In the US, corporate profitability has largely come at the expense of their workers. Labor’s share of US national income declined from 2000-2015, but has now begun to rise. Demand for labor is surging as the economy reopens, which means companies will likely need to bid up wages in order to attract workers.

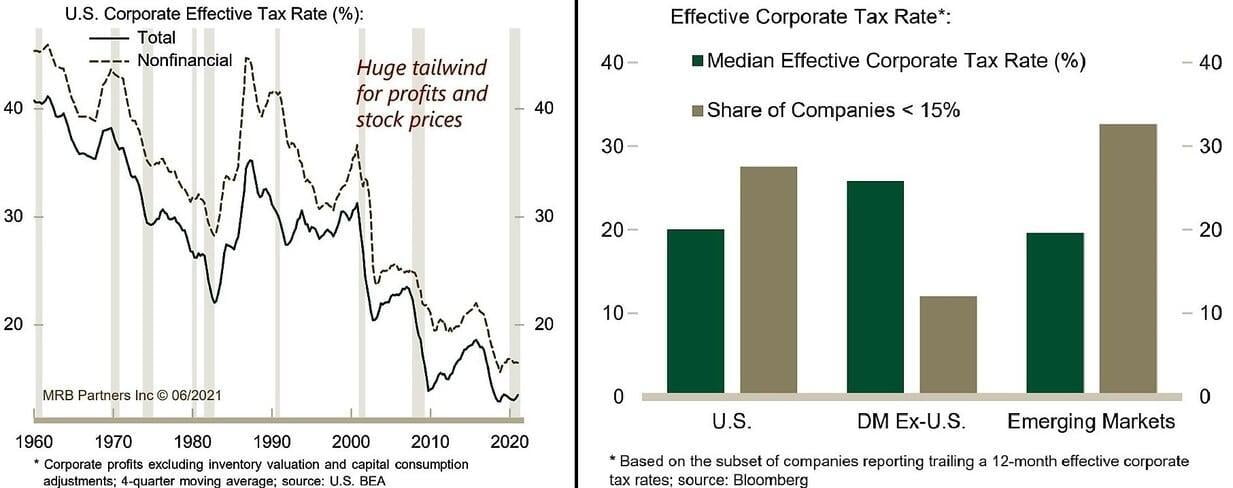

US corporate tax rates have been in a broad decline and currently sit near all-time lows. With record government deficits due to pandemic stimulus, this money will need to come from somewhere and corporations are paying their smallest share in decades.

We expect corporate tax rates to rise going forward, providing another headwind to profitability.

Furthermore, the G7 agreement to establish a 15% global minimum tax will hit US firms harder due to their elevated margins and profitability. In the developed world, the US has the largest share of companies paying less than 15% effective tax rates.

PORTFOLIO STRATEGY

We usually close by discussing our favourite investments, but this time we’re focusing on what to avoid.

- US Equities: On the surface, investing in the US seems like a home run. They were the top performing market last decade and their economy is roaring as a result of record stimulus and a fast vaccine roll-out. Unfortunately, markets are forward looking and this past success is leading to future problems. Expectations and valuations are elevated, inflation is rising while the Fed remains complacent, and the era of low corporate taxes and minimal regulation is ending (mega-cap tech anti-trust lawsuits).

- Bonds: Rising inflation and an ongoing economic recovery will eventually push interest rates higher. This is bad news for bonds, particularly long-term government bonds. Currently US treasuries pay just 0.86%, 1.44% and 2.05% on the 5, 10 and 30 year maturities respectively. German 10-year bonds are still paying negative yields, which effectively means you’re paying the government to hold your money. This is crazy, unsustainable and more than likely to result in significant long-term capital erosion.

Investment success going forward will be more about avoiding these asset classes than picking the top performers. Unfortunately for most investors, they are heavily overexposed. A balanced 60/40 mutual fund has 40% in bonds and 36% in US equities (US makes up 60% of global market cap). To make matters worse, Canadians pay the highest mutual fund fees in the developed world, averaging 2.1%. The result is most Canadian mutual fund investors are likely to experience low, or even negative real returns (net of inflation) over the coming decade.

By avoiding these asset classes and keeping our fees low we expect to generate far better returns for our clients. If you have friends or family who are invested in mutual funds, please forward them this commentary. We always appreciate referrals and have recently added an advisor, Naheed Gilani, CFA, to our team to ensure we have the capacity to meet all our current and prospective clients needs.

If you have any questions, comments or would like to become a client please do not hesitate to reach out. You can email me or schedule a free 30 minute consultation using the link below.