When the unstoppable force runs into the immovable object

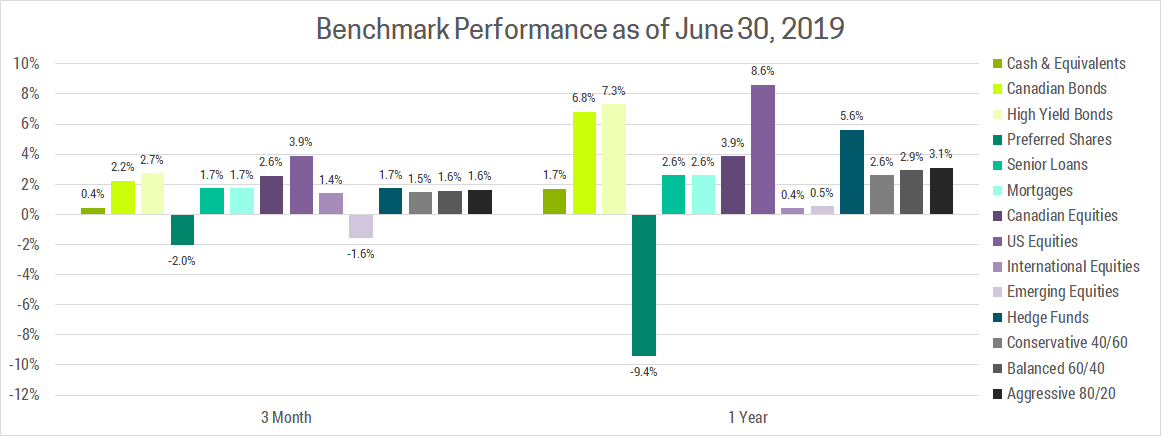

After 4 straight months of gains starting in January, markets pulled back in May as trade talks between the US and China deteriorated. June saw markets recover as the Federal Reserve signaled they would halt interest rate increases, and possibly cut them in order to stimulate the economy if needed. The result was slightly positive Q2 performance across most asset classes.

Since the trade war is likely to be an ongoing headwind for markets it’s worthwhile to look at it in more detail. While talks will be ongoing, make no mistake, US/China relations are broken. At the G20 summit this Tuesday, Trump and Xi did agree to resume talks and halt a further escalation of tariffs, however this is likely to be another temporary truce. Ultimately, this is a battle over global economic and technological supremacy and is likely to drag on for decades to come.

Since the end of WWII, America has been the dominant global superpower and is accustomed to their place in the world. The very idea that another country could surpass them is an assault on who they are. Meanwhile, just 25 years ago over 90% of China’s population was living in extreme poverty. Today just 1% live below this threshold. China’s meteoric rise seems far from over as their ambitious leader Xi Jinping explicitly stated the following goals for their future:

- 2025: Become the dominant power in 10 leading technologies including AI, robotics, aerospace, biopharmaceuticals and quantum computing

- 2035: Be the innovation leader across all advanced technologies

- 2049: Be unambiguously #1 to coincide with the 100th anniversary of the People’s Republic of China

So, what happens when the seemingly unstoppable force of a rising China runs into the immovable object that is the US? Looking back at 500 years of history we’ve seen 16 cases where a rising power threatened to displace a ruling power and the result in 75% of cases was physical war. Therefore, the current economic/trade war is a decent outcome and similar to the Cold War, investing through it can be extremely profitable. Furthermore, we don’t believe the current economic war will escalate beyond trade given how negatively this would affect their interdependent economies. Even if the trade war does escalate, China has lots of room to provide fiscal and monetary stimulus to support their economy. As such, we continue to view corrections from periodic trade war flare-ups as buying opportunities.

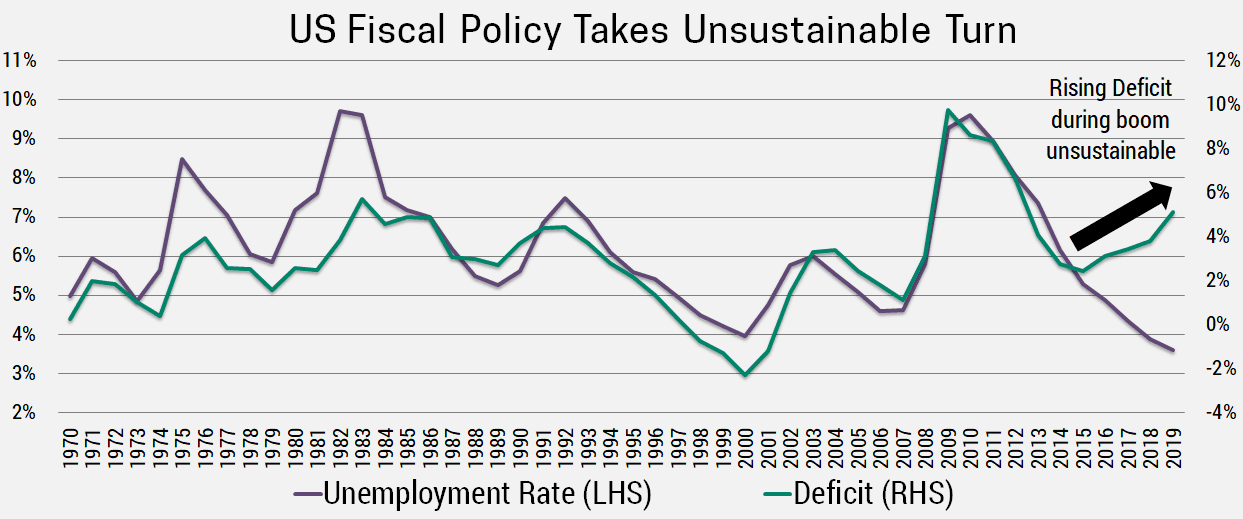

While trade is likely to remain a headline risk, excessive consumer, corporate and government debt continues to be the most significant risk to the global economy. The US government has accumulated over $22 trillion in debt and is on track for over a trillion dollar deficit this year in the midst of their longest economic expansion in history. Prudent fiscal policy is to save money (or at least reduce your deficit) during an expansion so you have the ability to stimulate the economy during a recession. As seen in the chart below, the US is currently doing the opposite.

Clearly this debt trajectory is unsustainable and as Herbert Stein famously said, “If something cannot go on forever, it will stop.” For the US, this means increasing revenue (taxes) or decreasing expenses, both of which will slow the economy. This, coupled with our last commentary on value vs growth, is why we remain underweight US equities.

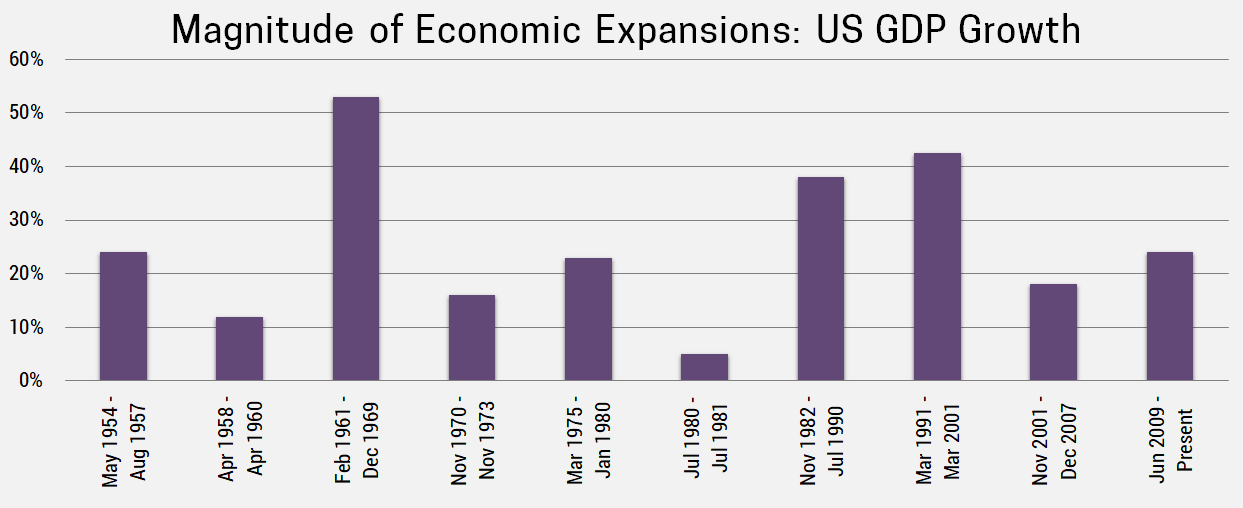

So, what should investors do given the ongoing trade war and rising debt levels amidst one of the longest economic expansions on record? Well, as mentioned above we don’t believe the trade war will escalate materially, and even if they do central banks have expressed willingness to stimulate the economy if needed. As stated in our Q1 2019 commentary, we don’t believe debt will be an issue until inflation forces central banks to raise interest rates (no signs of this yet, but we continue to monitor the situation). As for the length of this recovery, it’s worth noting that recoveries have been getting longer and that while this expansion has been long, it is relatively small in terms of GDP growth.

Meanwhile, we are seeing lots of indicators that don’t correspond with market tops including:

- Valuations remain reasonable outside the US

- Investor sentiment is below historical averages

- Money is not flowing into equity, it’s going out

We continue to believe we are late in this economic cycle, but not at the end. We have positioned client portfolio's to benefit from a sustained, albeit modest, economic expansion. Meanwhile, prudent diversification across asset classes and regions ensures downside protection against any eventuality.