There’s a lot of misconceptions regarding the coronavirus (COVID-19), so I want to devote the first part of this commentary towards education. Then we will discuss the financial implications and what we’re doing in our investment portfolios.

UNDERSTANDING COVID-19

Before we dive in, it’s worth mentioning that our scientific knowledge of COVID-19 is in its infancy, there’s lots that we don’t know. This is a big reason stocks have fallen so far, markets hate uncertainty. That being said, let’s start with what we do know.

- Symptoms: Fever, cough and shortness of breath.

- Protective Measures: Protecting yourself against COVID-19 is similar to protecting yourself from cold and flu. The WHO outlines basic protective measures here.

- Spread: The numbers will most certainly go up in the coming weeks and months, but a big reason is that we are now testing more people. The vast majority of cases are mild, so it’s likely the confirmed and suspected cases significantly under-reports the total. That said, testing is an important first step as containing the spread requires us to find out who’s ill, isolate/treat them and follow-up with close contacts for further testing and monitoring.

- Mortality Rate: There are many challenges estimating the mortality rate early in an epidemic. That said, it is clear the risk rises substantially for older individuals and those with compromised immune systems. In fact, the death rate for individuals under age 49 is ~0.2% (1 out of 500), versus ~15% (1 out of 7) for individuals over 80.

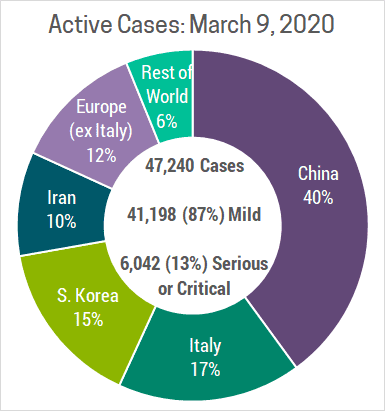

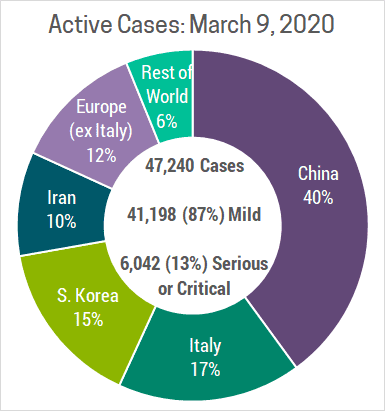

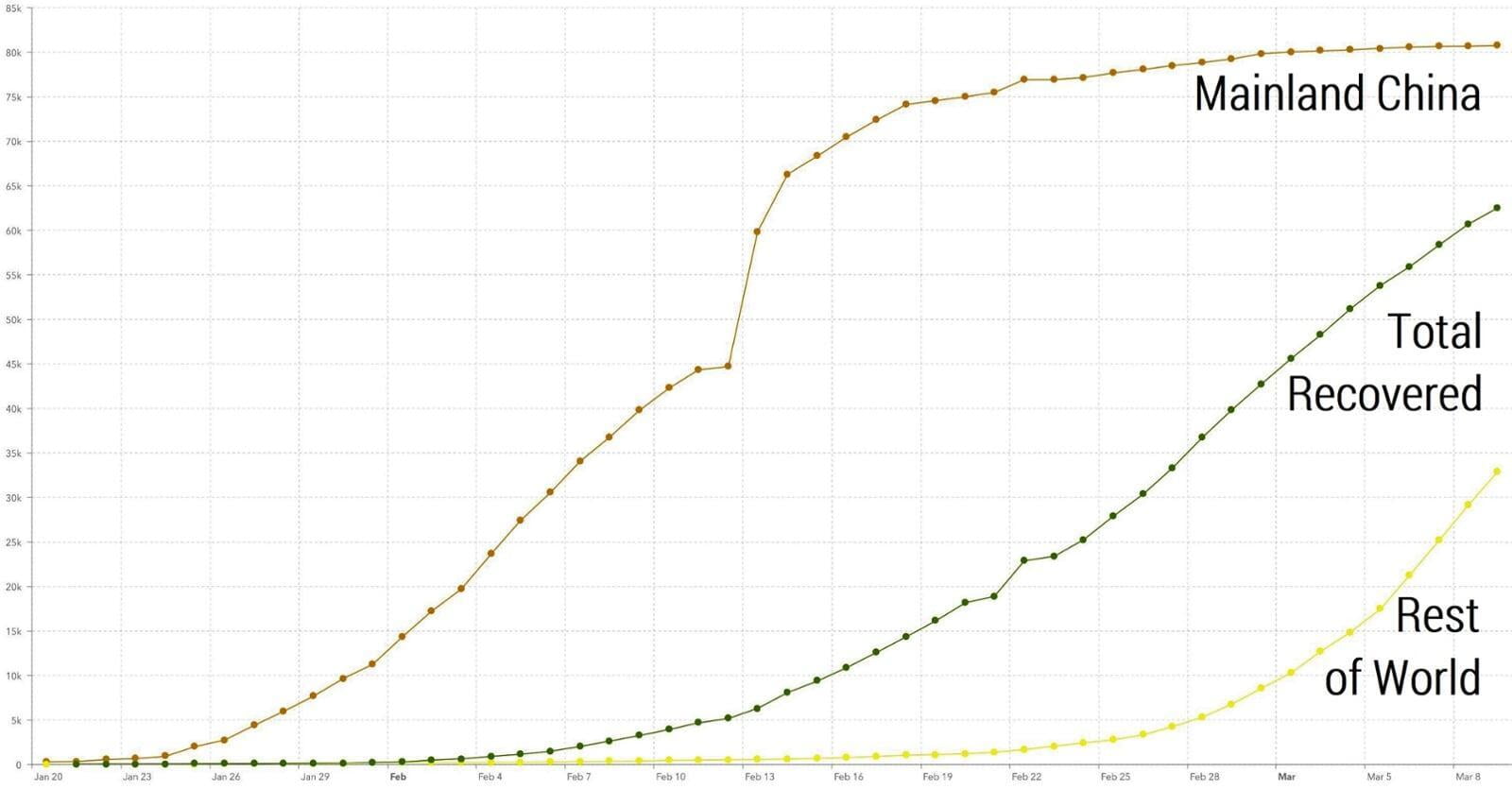

- Where we stand today: The chart below shows total active cases, meaning we’re ignoring resolved cases who have recovered or unfortunately passed away. The media loves reporting total cases as fear helps drive web traffic and therefore ad revenue, but what really matters is active cases as those are the ones contributing to the spread.

ECONOMIC IMPACT OF COVID-19

A lot of the economic impact of COVID-19 is a result of our efforts to contain the spread. Specifically, this includes quarantines (most recently in Italy), factories shutting down, supply chain disruptions, consumer purchasing habits (especially travel), etc. In the coming months we’ll find out whether our containment efforts are proving successful, as they were with SARS, MERS, H1N1, Ebola, Zika, etc., or whether it will spread beyond our control.

If this does continue to spread, we will hopefully delay it in order to give our health care systems time to prepare. Specifically, as we are in the midst of cold and flu season, health care systems are already under strain and hospital beds are near capacity across many nations. As such, simply delaying COVID-19 until after cold/flu season would significantly lessen the impact and loss of life while making it easier to identify. There are also billions of dollars being spent to prepare and identify effective treatments, medications, supportive care, vaccines, etc. The longer we delay the spread. the better tools we will have to fight it, and more time to test those tools for safety and efficacy. In fact, the NIH anticipates the experimental vaccine will be ready for clinical testing in the coming months.

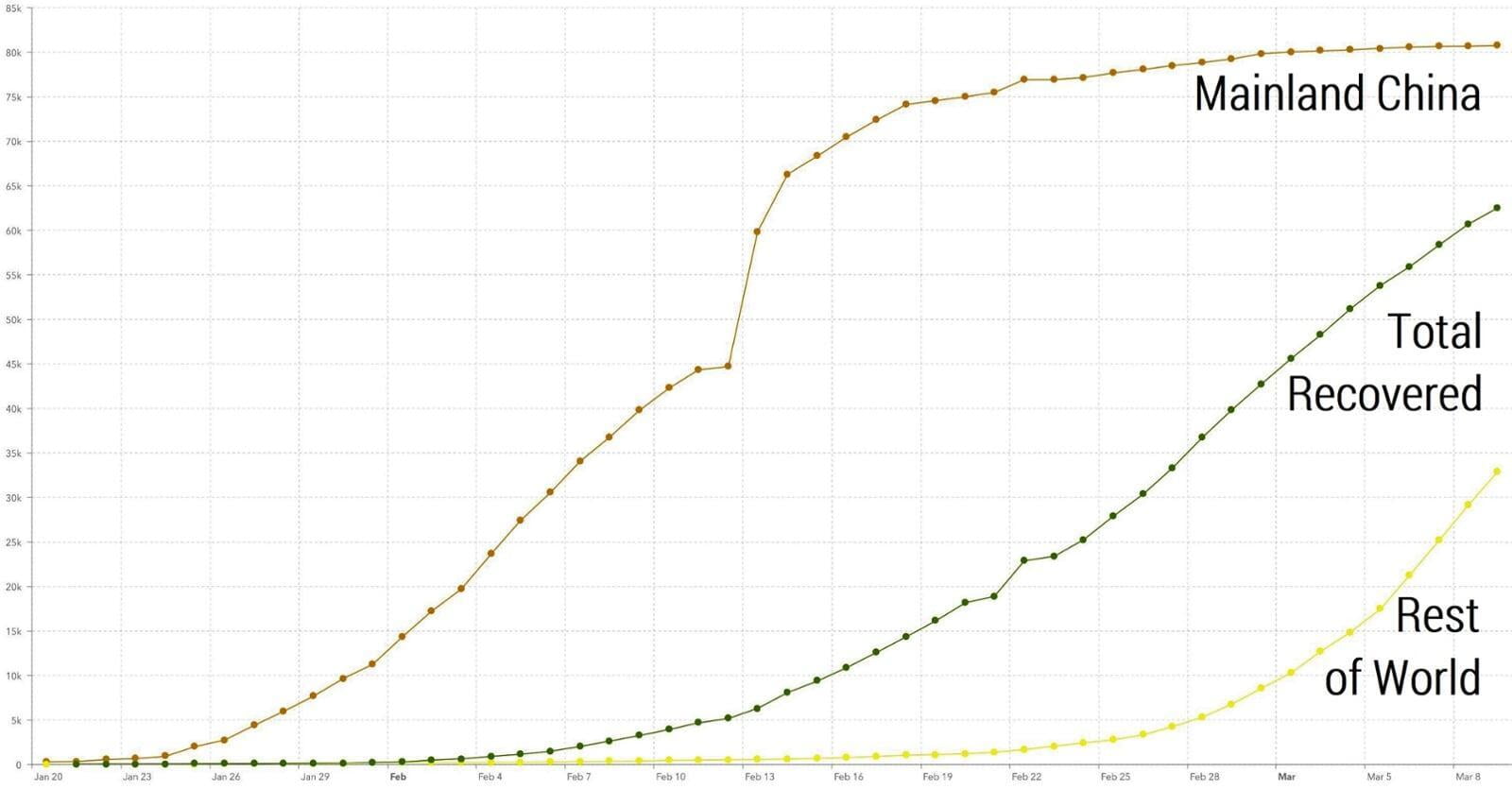

Will we succeed in controlling the spread of COVID-19? With a coordinated global effort the WHO seems to think so, stating that “China and other countries are demonstrating that spread of the virus can be slowed and impact reduced through the use of universally applicable actions, such as working across society to identify people who are sick, bringing them to care, following up on contacts, preparing hospitals and clinics to manage a surge in patients, and training health workers.” We can see the impact of these actions in the drastic slowing of new cases in China.

WHEN IT RAINS IT POURS

Unfortunately, cases outside of China are rising rapidly, which is the main concern for investors. To complicate matters further, falling oil demand stemming from COVID-19 prompted OPEC to propose a production cut to prop up prices. This was contingent on their allies, particularly Russia, agreeing to similar production cuts. This weekend Russia surprised markets by refusing to cut production, prompting OPEC to reciprocate, launching oil producers into an all-out price war which sent oil prices plummeting. I guess it’s true what they say, “when it rains, it pours”. So what’s an investor to do?

Well, fortunately there is some good news buried under all these attention grabbing, fear inducing headlines. Specifically, central banks have begun cutting interest rates. As a result, all that cash on the sidelines that we discussed in our Q3 2019 newsletter will be earning less interest and with falling asset prices, may find its way into productive investments. Meanwhile, governments are working hard to introduce stimulus packages, further boosting the economy. These effects will take time to impact the real economy, but when the current fear abates, we expect this will set the stage for a lasting recovery. Investors should also remember that markets are forward looking, so all we need is to see light at the end of the tunnel for asset prices to rebound.

It's fitting that in our last quarterly commentary we spoke of “process driven investing”. With all the uncertainty and fear surrounding COVID-19, these are precisely the moments when you need to adhere to a process. Specifically, this is why we diversify. Stock markets have certainly taken a beating, but the Income side of our portfolios has held up much better. This has protected clients on the downside, but also gives us the opportunity to “buy low, sell high” by rebalancing from asset classes that have performed well (like bonds) into asset classes that have performed poorly (like stocks). Specifically, we have taken this opportunity to sell high-yield bonds and buy value stocks across all client accounts.

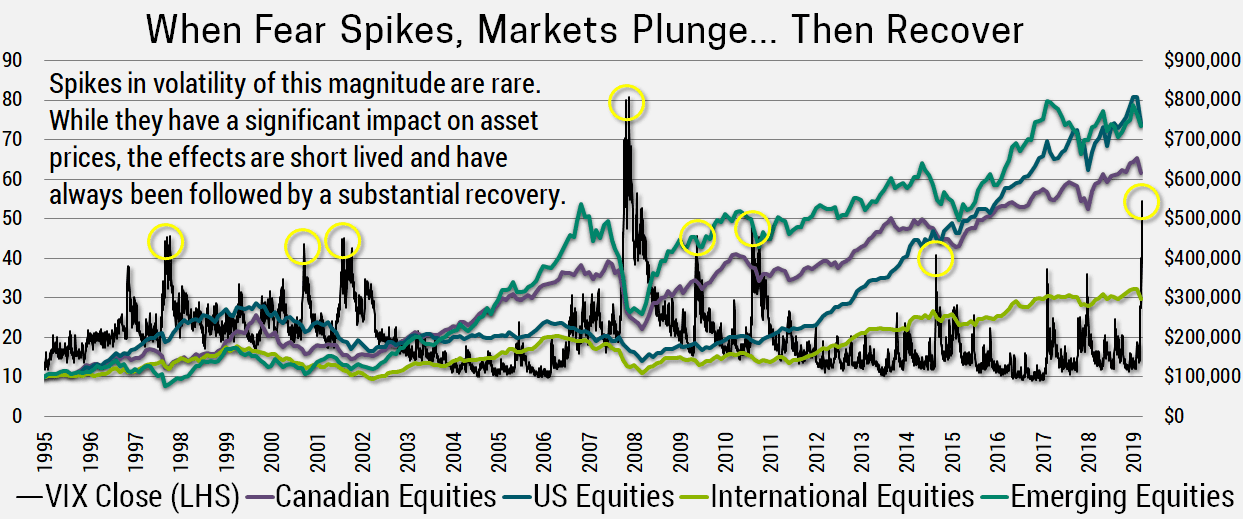

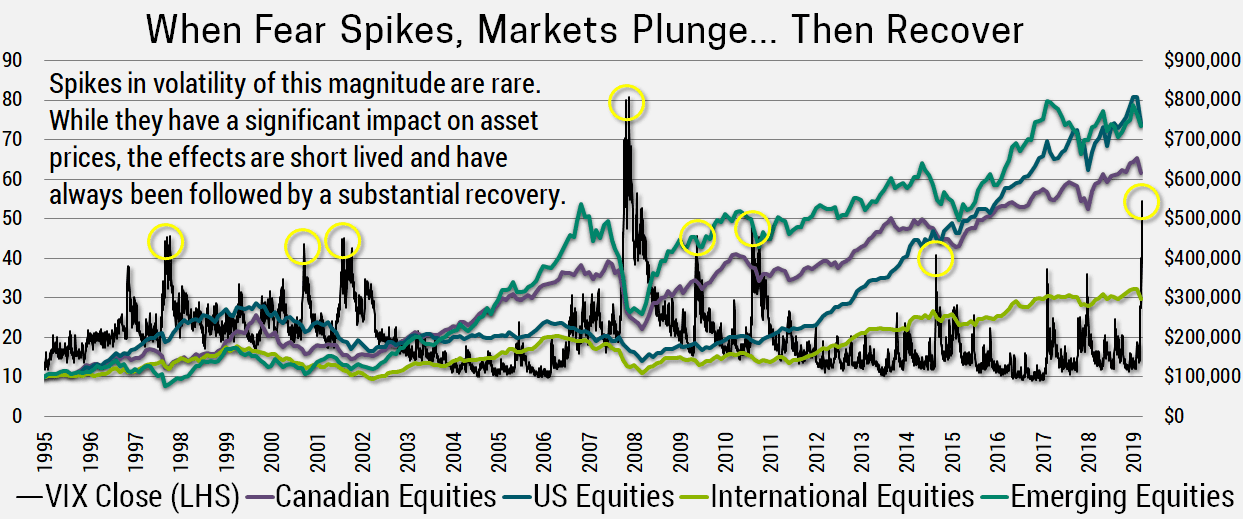

The idea of buying stocks at a time like this may seem scary, after all we really don’t know what’s going to happen in the coming days, weeks or months. That said, we expect long-term investors with at least a 5-year time horizon will look back on today as an excellent buying opportunity. After all, buying during times of fear has worked wonders in the past. The chart below shows how significantly the VIX (otherwise known as the volatility or fear index) spiked and the corresponding correction in global markets. The VIX spiked above 40 just 7 times in the past 24 years and is currently at 54.46, a number only exceeded during the 2008 financial crisis.

Over time, we expect economic growth will resume, headlines will become less gloomy and asset prices will rebound. This process normally takes a few months; therefore, the best course of action is to stay invested in a properly diversified portfolio with multiple sources of return.

While most investors avoid the market during times of uncertainty and volatility,

history shows us that this is the best time to invest.

In fact, 2 year annualized returns following fear of this magnitude averaged 12.9% in Canada, 10.3% in the US and 17.6% in Emerging Markets! Stocks offer investors better long-term returns because they can be painful at times to hold. Unfortunately, this is one of those times.